It takes seven steps

Ere intervention arrives

Was last night step five?

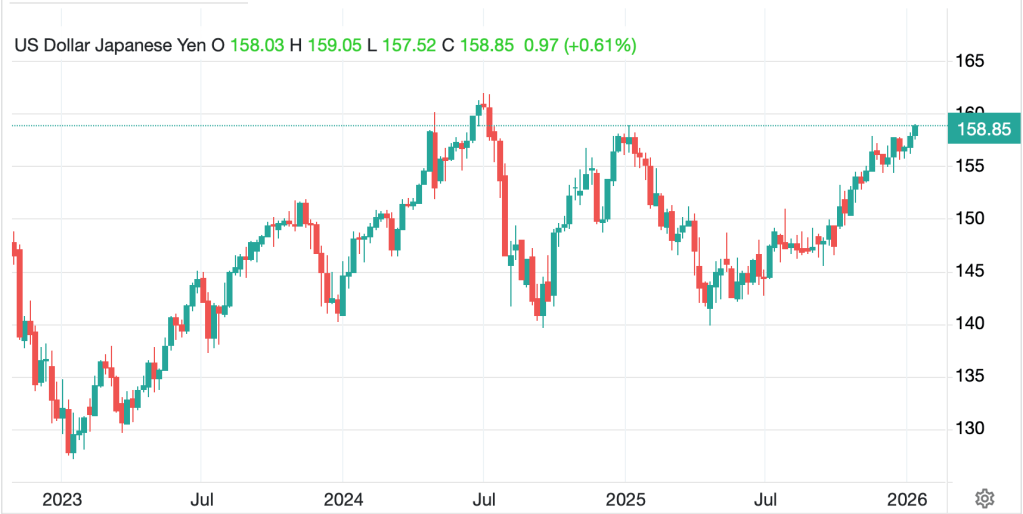

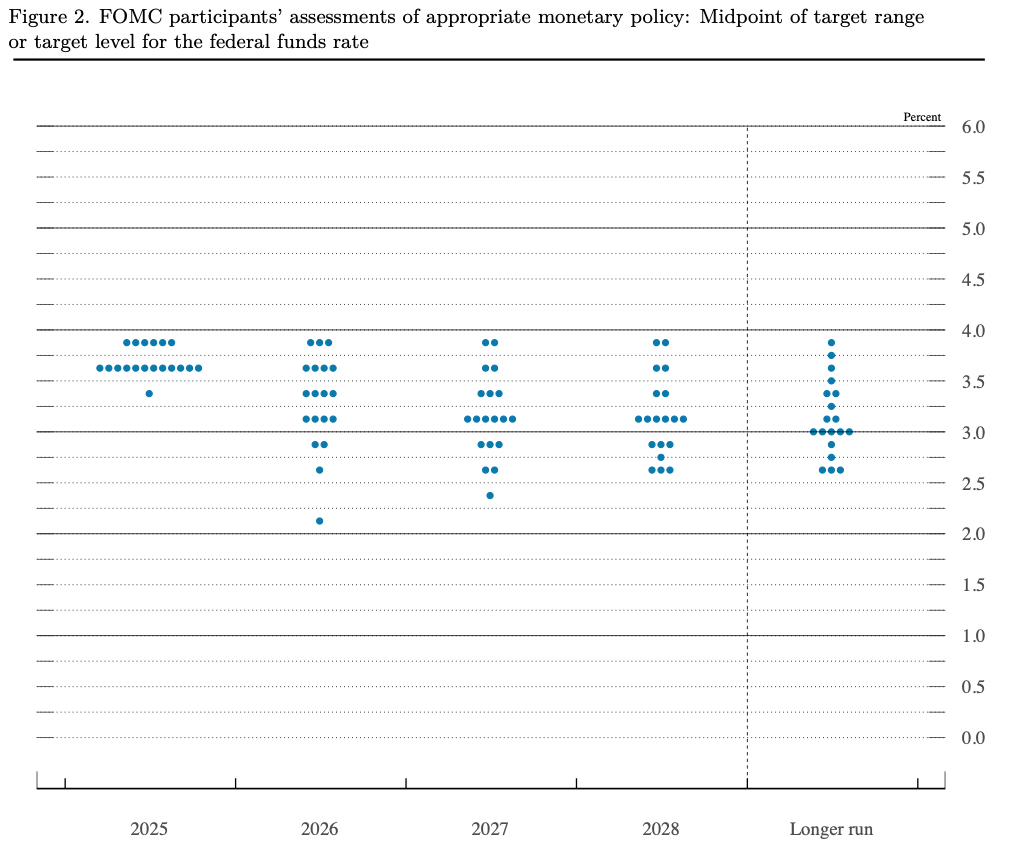

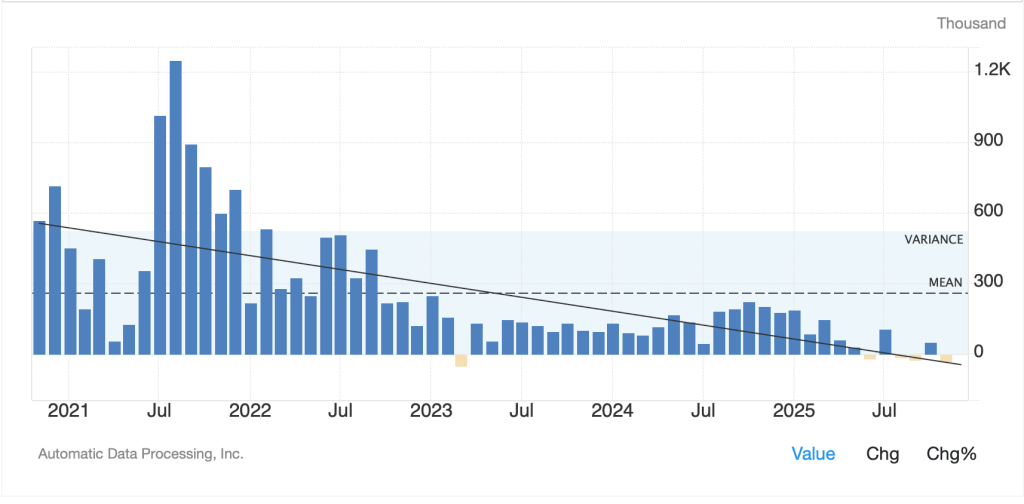

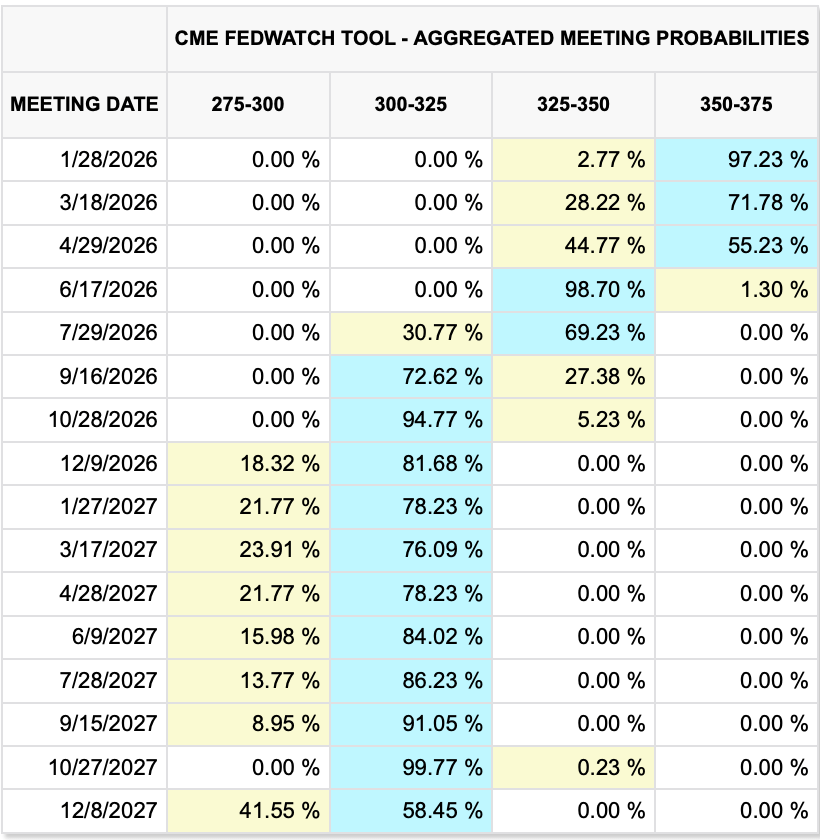

The yen continues to be in the crosshairs of traders as further weakness is anticipated based on several things I believe. First, there had long been an assumption that the Fed was going to cut rates further, especially with President Trump haranguing Chairman Powell constantly on the subject. In addition to that, there continues to be an underlying thesis amongst many pundits that the US economy is weakening dramatically to drive that rate decision. Yet recent data belies those facts, notably the Atlanta Fed’s remarkable GDPNow jump, but also relative stability in other data, including employment. The upshot is the futures market is now pricing a mere 3% probability of a cut at the end of this month and not pricing the next rate cut until June, after Chairman Powell is gone. One key leg of the yen strength argument is weakened.

Source: cmegroup.com

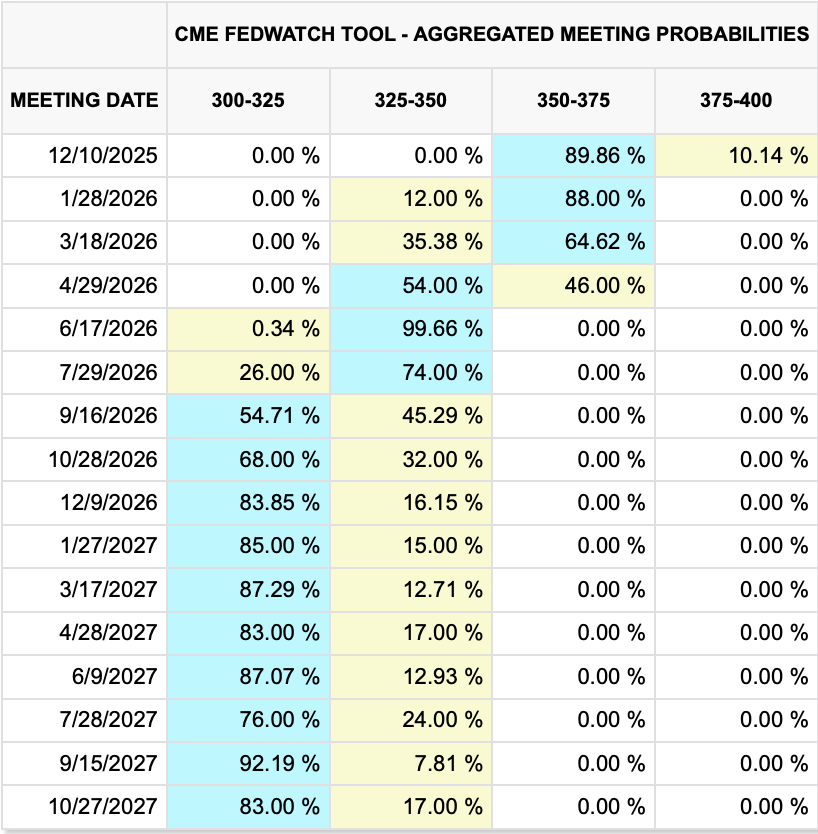

Second, there continues to be a belief that the BOJ will continue to hike interest rates, and perhaps they will, but it appears that the pace of those hikes will be far slower than previously anticipated. Currently, the market is pricing just 50bps of hikes for all of 2026. At the same time, Takaichi-san is set to “run it hot” in Japan just like in the US, pumping up fiscal stimulus and forcing the BOJ to come along for the ride. The implication here, which is what we are seeing in the markets right now, is that a larger fiscal deficit will lead to strength in equities but a weaker currency. The second leg of the yen strength argument is failing here as well.

Which brings us to last night’s commentary from Satsuki Katayama, Japan’s FinMin, who explained, [emphasis added] “We won’t rule out any means and will respond appropriately to moves that are excessive, including those that are speculative. We’ve mentioned this to the prime minister today as well.” The kind of sudden moves we saw on Jan. 9 have nothing to do with fundamentals, and are deeply concerning,” she added. Her message was soon backed up by Atsushi Mimura, the ministry’s top official in charge of the yen, who reiterated that no options were being ruled out.

The bolded words are all part of the Japanese seven-step plan toward intervention. At this point, I feel like we have reached number five. The market responded predictably, with the yen strengthening vs. the dollar (and all its counterparts), albeit not all that much. Last night saw the yen trade at 159.45, its highest since July 2024 (the last time the BOJ intervened), before the comments helped bring it back a bit.

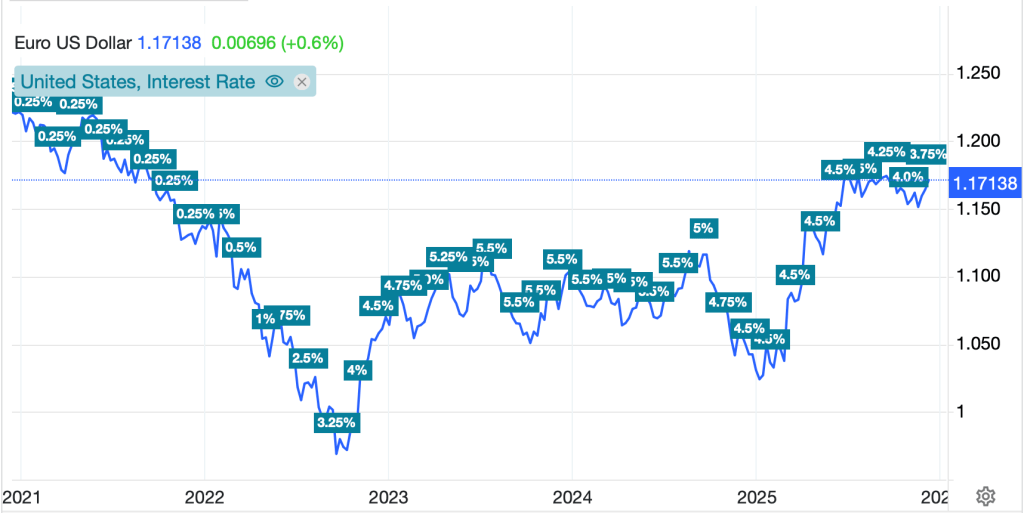

Source: tradingeconomics.com

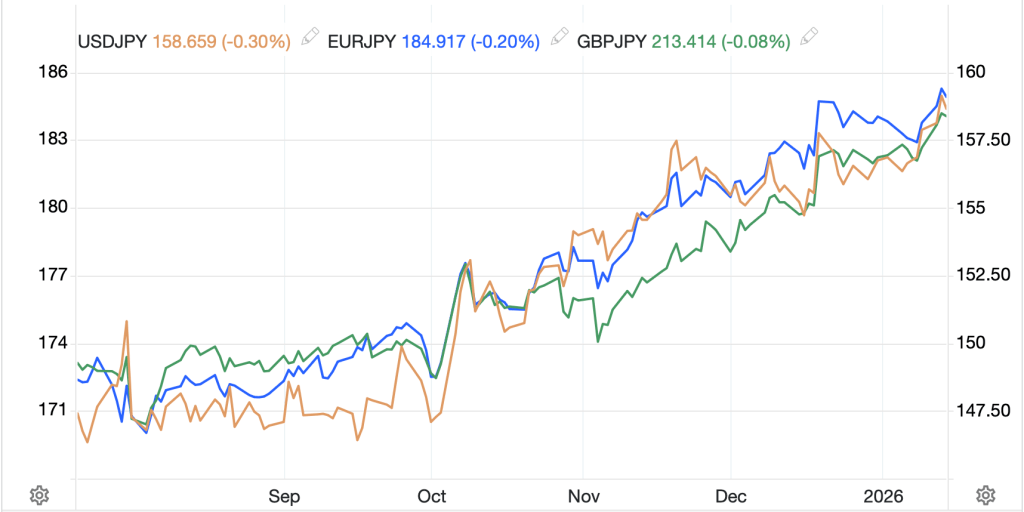

But one other area which the MOF/BOJ follow closely is not just the USDJPY exchange rate, but also the yen’s rate vs. other major currencies. If, for instance, the yen is only weakening vs. the dollar, that is one thing. However, a look at the chart below showing USDJPY, EURJPY and GBPJPY shows us that the yen is weakening against all those currencies pretty much in sync. In fact, this argues that the yen’s current weakness is a yen specific fundamental, not a speculative move, which should argue against intervention, as that will only be a temporary sop. However, my take is when we get to 160 or 162, which I believe is coming, we will see the BOJ selling aggressively.

Source: tradingeconomics.com

Ironically, the one currency against which the yen has been weakening steadily that I’m sure delights the BOJ/MOF is the Chinese yuan. Since Liberation Day in the US, the yen has fallen more than 17% and continues to slide vs. the yuan as it has been doing for the past five years. It is not hard to believe there are voices in the Japanese government that see that move and recognize how much it helps the Japanese export sector and caution against trying to arrest the yen’s weakness too aggressively.

Source: tradingeconomics.com

I look forward to much more dialog on this subject and expect that soon, we will be hearing about the end of the carry trade, yet again. To my eyes, until Japanese fundamentals change, or at least appear to be moving in the right direction, the yen will struggle. So, let me know when the fiscal deficit shrinks, or GDP jumps to 4% or inflation slides back to 1%. Until then, they yen is damaged goods.

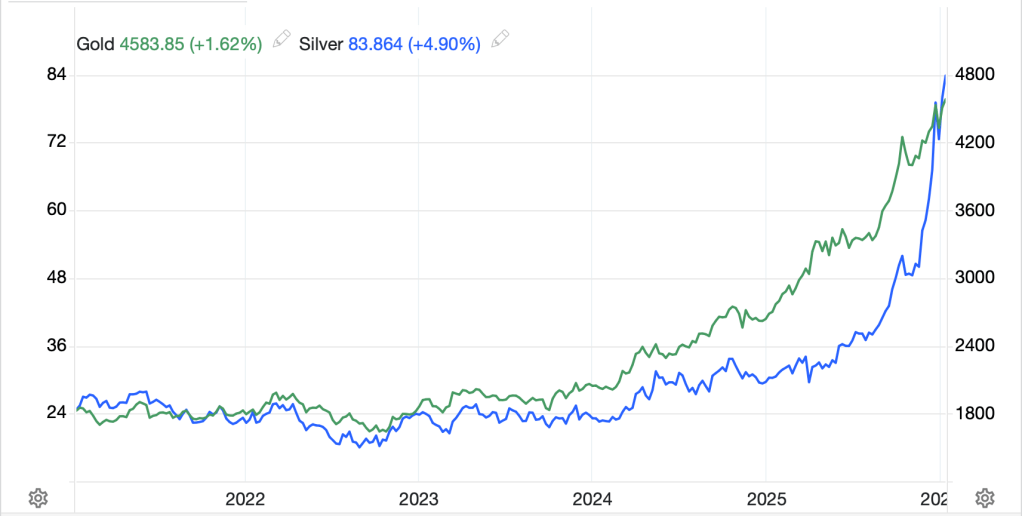

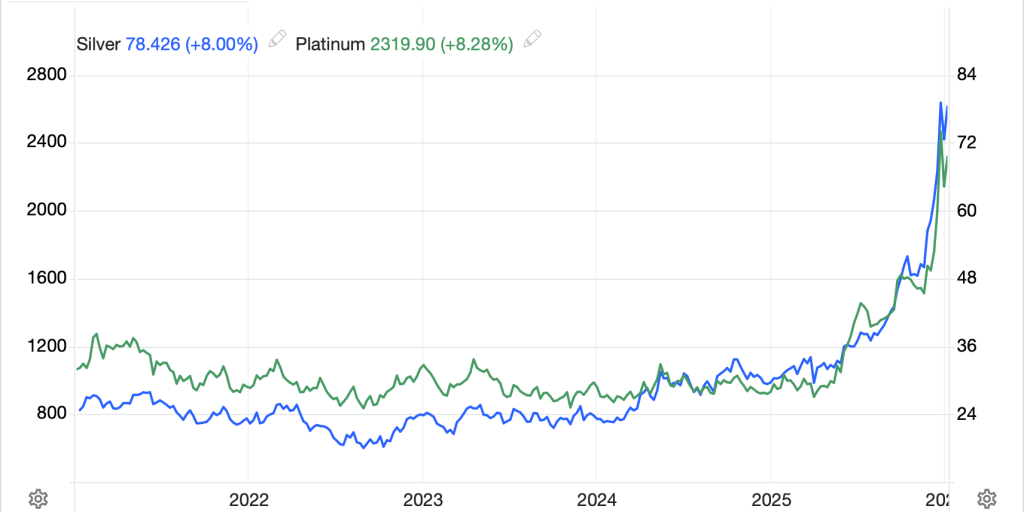

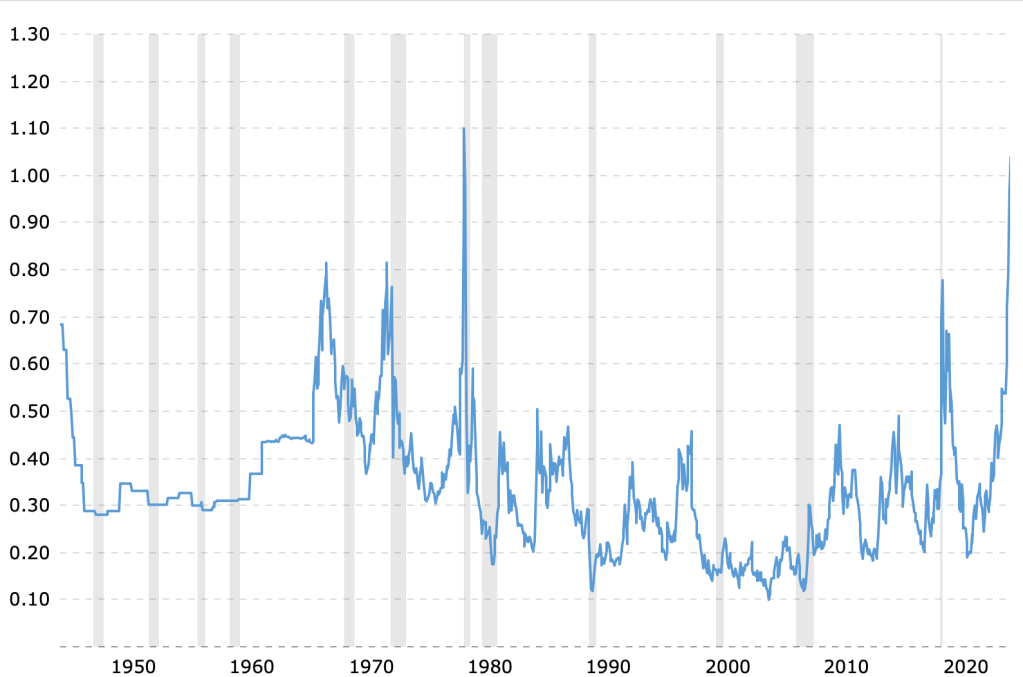

As to the rest of the market, precious metals continue to be the shining stars with the whole sector higher this morning (Au +1.0%, Ag +4.2%, Pt +2.0%) and that move taking copper (+0.4%) along for the ride. Last night the CME raised its margining requirement and changed its nature by requiring a percentage of the value, rather than a numeric amount per contract. My friend JJ, who writes the Market Vibes substack wrote a brilliant piece last night explaining how the flows are evolving in the silver market. To sum it up, at this point, there appears no end in sight for the demand as short positions are covered by new shorts. Metal for delivery remains scarce and despite the extraordinary shape of the move, it appears to have more steam to drive it forward. Markets like this are extremely difficult to trade, and history shows that movements in the shape seen below reverse very sharply. But as Keynes explained 100 years ago, markets can remain wrong longer than you can remain solvent. I am happy I have been long silver for quite a while but am having a hard time figuring out what to do now!

Source: tradingeconomics.com

Meanwhile, oil (+1.4%) continues to rally on concerns that the Iran situation will lead to one of two outcomes, either a substantial decline in production as the regime collapses, or an effort by the regime to close the Strait of Hormuz which will impede shipping and reduce supply as they try to inflict pain on the US and the rest of the world who are rooting for the uprising.

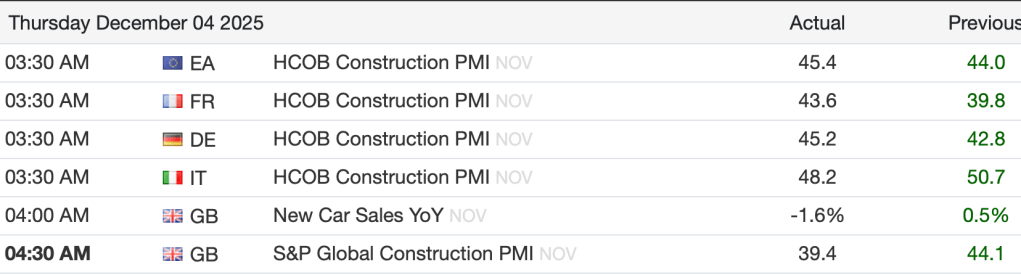

Heading back to paper markets, yesterday’s weakness in the US was followed by a more mixed picture in Asia with Japan (+1.5%) rallying on continuing hope for more fiscal stimulus. HK (+0.6%) benefitted from news that China’s trade surplus hit a new record high of $1.2 trillion (remember when they were going to grow domestic demand?) but Chinese shares suffered (-0.4%) after the regulators there raised margin requirements to 100%. As to the rest of the region, it was far more green than red, although India continues to be a laggard overall. In Europe, mixed is also the best description with the DAX (-0.35%) lagging while we have seen modest gains in the UK (+0.3%) and France (+0.2%). Otherwise, it is hard to get excited about activity here today. There continue to be existential questions about the EU and which nations will enact EU directives given that Poland, Hungary, Italy and the Czech Republic seem to be ignoring the latest issues like the Digital Asset Tax. As to US futures, at this hour (7:00) they are softer by about -0.25% across the board.

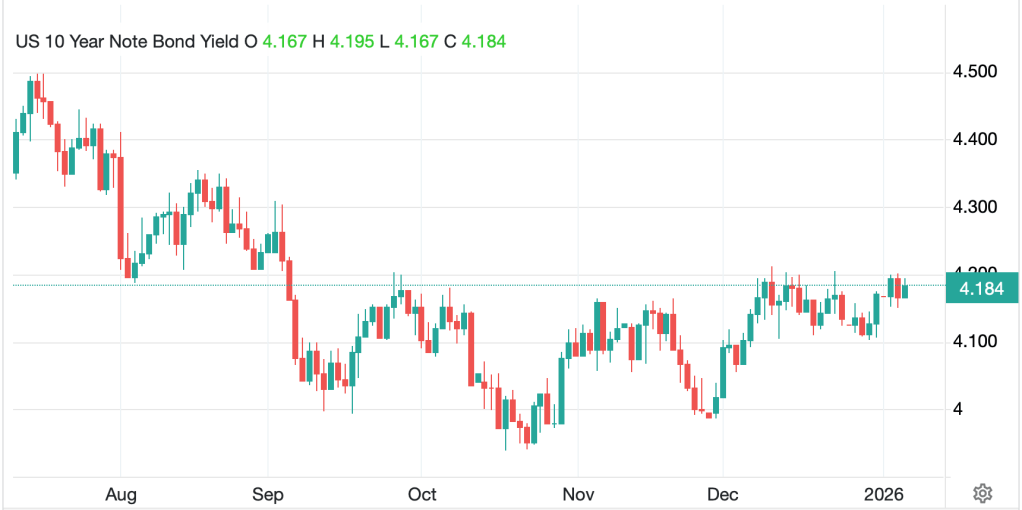

Bond markets (except Japanese ones) remain completely uninteresting. Treasury yields have slipped -3bps this morning and European sovereign yields are lower by -1bp. Despite all the sound and fury about specific issues in markets, fixed income investors remain nonplussed by everything for now. If/when that changes, we will need to watch things carefully.

Finally, aside from the yen (+0.3%) there is little to discuss overall. The DXY is still trading right around 99 and there has been very little movement of note. Relationships that we would expect (ZAR and Au, NOK and oil) remain intact, but despite the metals dramatic movement, the rand is just gradually appreciating.

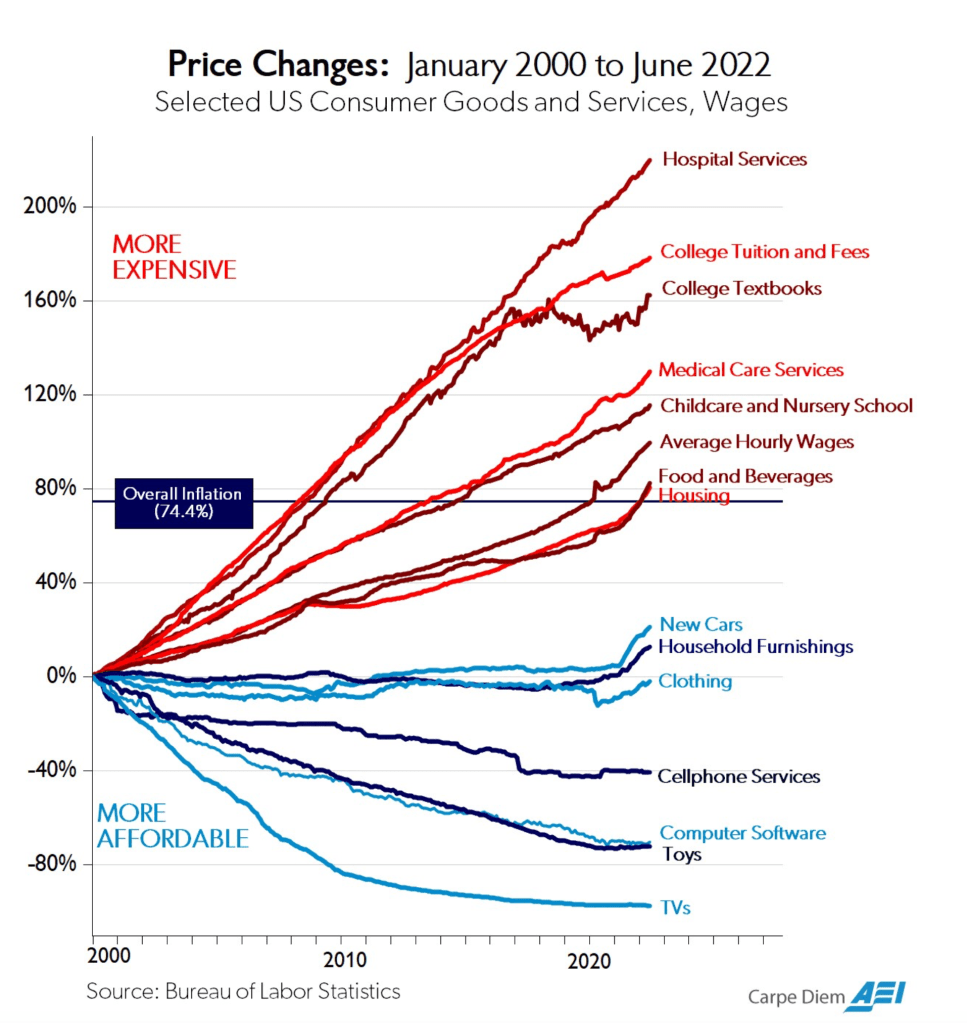

On the data front, yesterday’s CPI printed slightly softer than market expectations, but it is hard to get excited that inflation is heading back to target anytime soon. @inflation_guy, Mike Ashton, had an excellent write-up here explaining what is going on and why much lower inflation is unlikely. Ultimately, despite a lot of discussion regarding rental rates, those figures are not representative of the rental market as a whole and shelter costs continue to climb. Absent a serious decline in goods inflation, it will be virtually impossible to get back to 2.0% on any sustainable basis.

As to today, it is a hodge podge of current and old data with Existing Home Sales (exp 4.21M) the only December number. We see November Retail Sales (0.4%, 0.4% ex-autos) and PPI for both October and November which seem unlikely to impact markets greatly. We also see EIA oil inventory data where a small draw is expected for crude but a build for gasoline. Last week saw a massive build in products which likely helped weigh on the price last week. But this week, things are different.

We also hear from five more Fed speakers including Steven Miran, who will undoubtedly make his case for aggressive rate cuts again. Then at 2:00 we get the Fed’s Beige Book.

Drinking from a firehose seems an apt metaphor for market analysts trying to make sense of the current situation. Stepping back, I have never understood the market pricing for more rate cuts given the economy’s resilience. The twin stories, in my estimation, are a growing level of fear regarding the debasement of fiat currencies, hence the move in metals, and the fact that the US remains the cleanest dirty shirt in the laundry, hence my preference for the dollar vs. other fiat currencies. But on any given day, be careful!

Good luck

Adf