It wasn’t but three weeks ago

That pundits who felt in the know

Were sure the attack

On Vene would crack

The world, and more chaos bestow

But that news, so quickly, has faded

While Greenland fears have been upgraded

The pundits were sure

That war was the cure

And Europe would soon be invaded

Now as it turns out, what we’ve learned

Is NATO, which had been concerned

Has ‘greed to a deal

Which stopped Denmark’s squeal

As Trump, to the US, returned

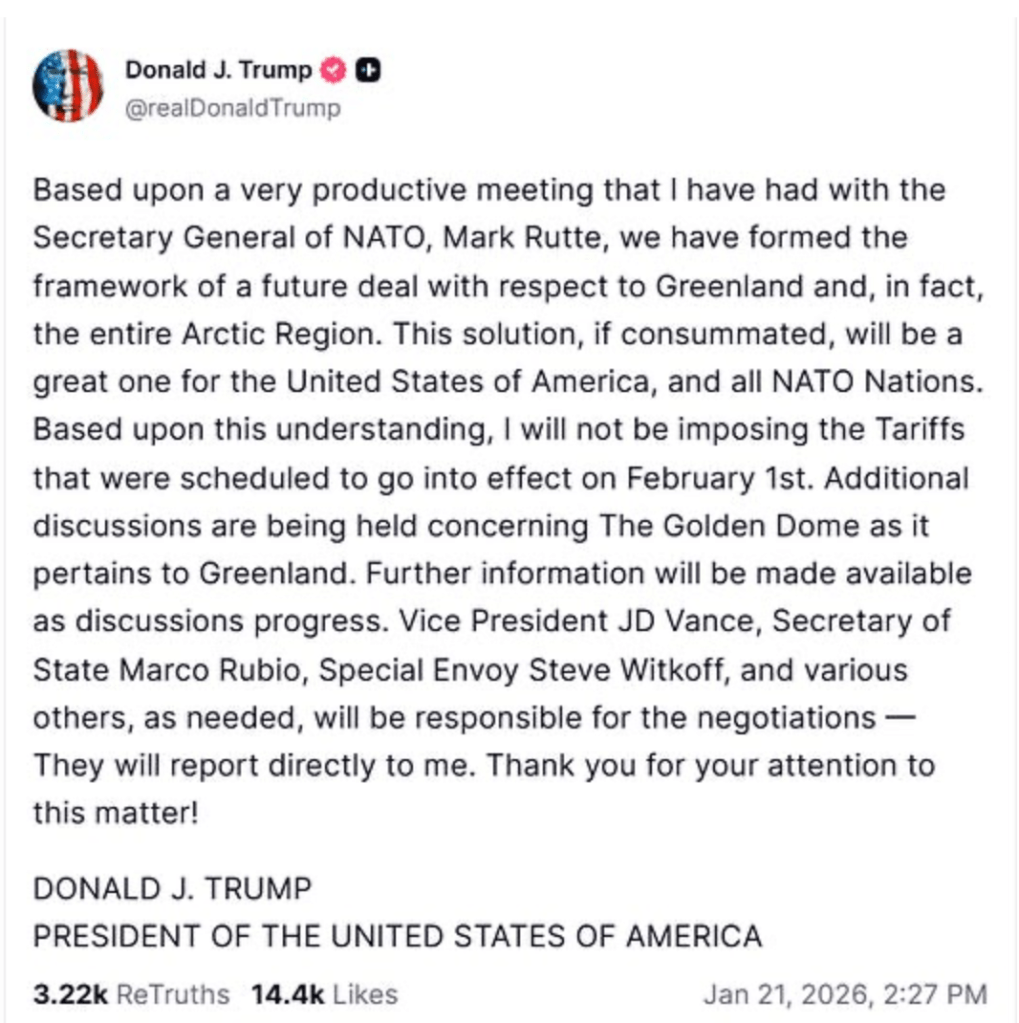

It is certainly difficult to keep up with current events these days, especially for the punditry who feel it is critical they demonstrate expertise on every issue, given the speed with which the issues change. All that effort to understand the geopolitics behind ousting Nicholas Maduro has been forgotten in less than 2 weeks as they needed to pontificate on Greenland and its importance. If, as the president’s TruthSocial post below is the current lay of the land, by Monday, Greenland will return to its historic obscurity as President Trump will move on to the next issue of his choosing. In fact, this morning, the WSJ is claiming Cuba is next on the list, which, while it wouldn’t be that surprising, has to date only been mentioned in passing by Mr Trump.

Here’s the thing about all the pontification regarding President Trump, nearly, if not all of it, is simply that, pontification by outsiders who have no idea about what is really happening. These folks are not sitting in the Oval Office when the President is meeting with his advisors discussing strategy and are generally wishcasting their views and creating a narrative around that. As I am also an outsider, all I can do is observe and try to ascertain how things might impact markets, but if you are not hearing it from the president or Secretary Rubio or someone like that, it is all speculation. However, one must admit, it is entertaining!

As I don’t know what the next ‘global crisis’ is going to be ahead of time, let’s turn our attention to markets and how they responded to the president’s speech in Davos as well as the news of the deal framework.

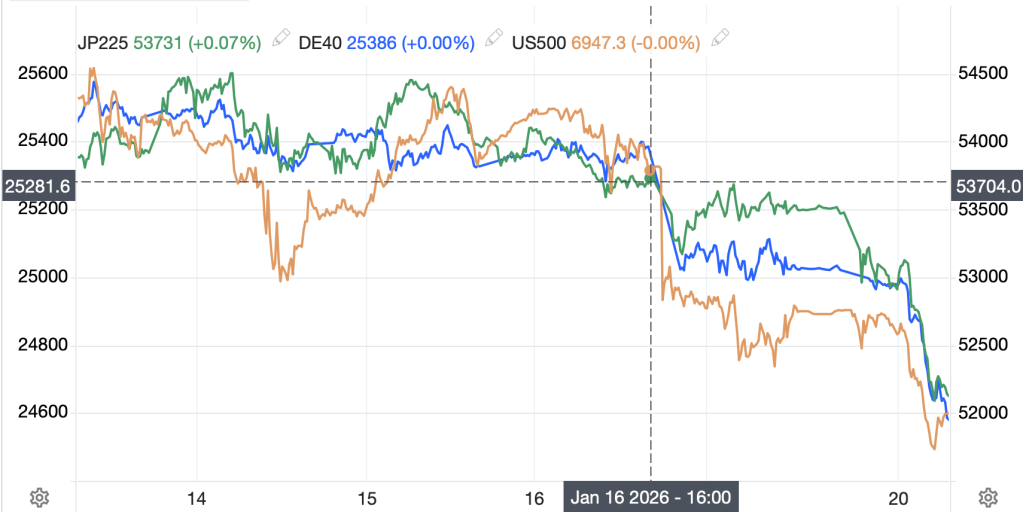

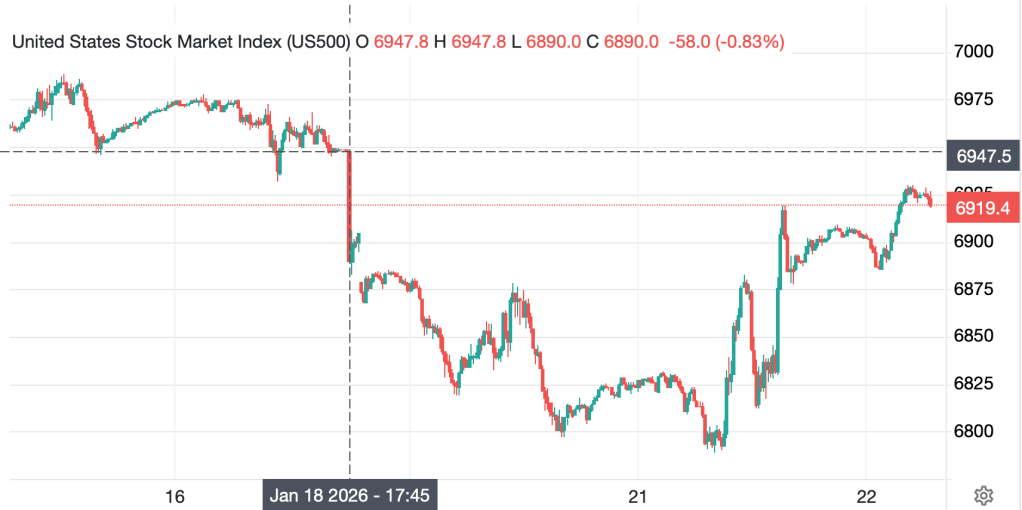

Equities were quite happy. After the sharp decline seen Sunday night, when the tariff threats were made, the S&P 500 has recouped nearly all of the losses as per the below chart. Yesterday saw US market gains of 1.2% across the board and futures, this morning, continue to rally, up about 0.5% across the board.

Source: tradingeconomics.com

It should be no surprise that things were bright in Asia as well, with Tokyo (+1.75%) leading the way as almost every exchange in the region was higher by a decent amount (Korea +0.9%, India +0.5%, Taiwan +1.6%, Australia +0.75%) but interestingly, China (0.0%) and HK (+0.2%) were the laggards. Perhaps good news for the West is not seen that positively there, although the story of regulators in China cracking down on possible stock manipulation by social media influencers has raised some concerns. After all, one of the biggest issues with investing in China by outsiders is the capriciousness of President Xi and the CCP as they decide what they don’t like that particular day.

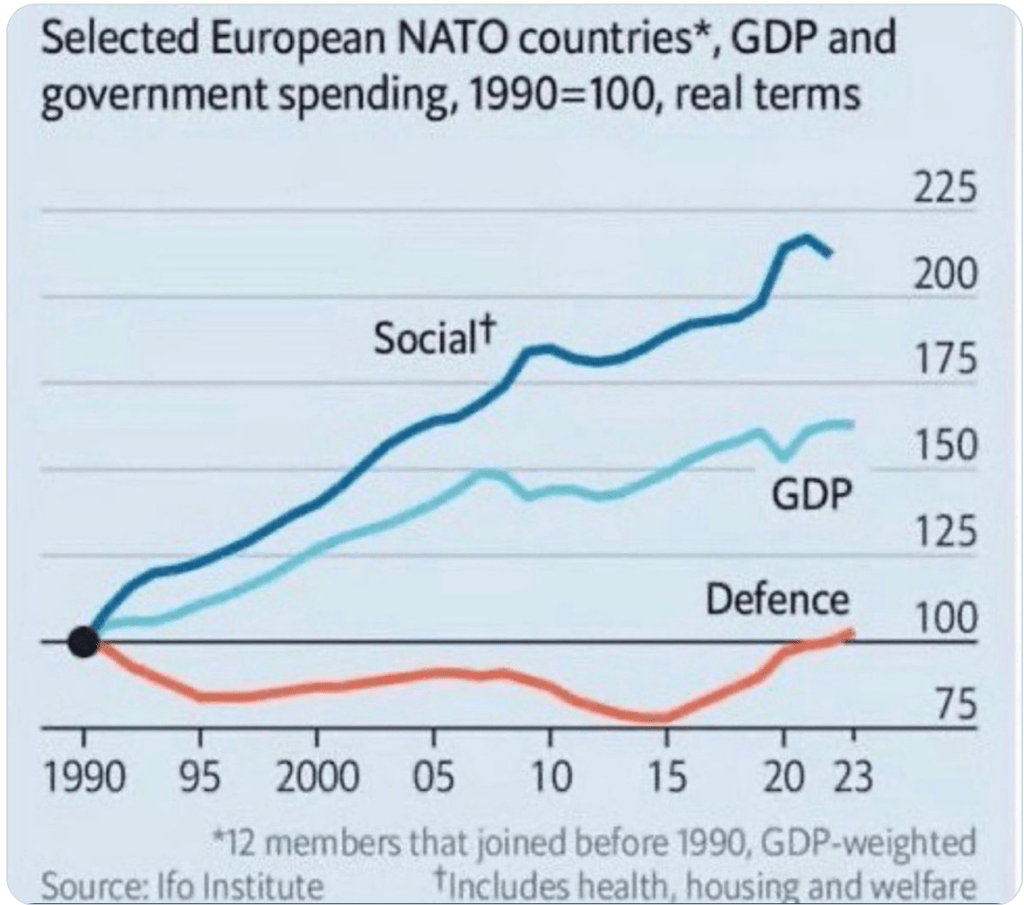

As to Europe, it should be no surprise that there has been a collective sigh of relief from investors there given the removal of the threat of more tariffs and the promises of more defense spending by European nations. So, gains across the board with the DAX (+1.2%) leading the way although the CAC (+1.1%) is right there as well with most of the rest of the nations seeing gains on the order of 0.5% to 0.75%.

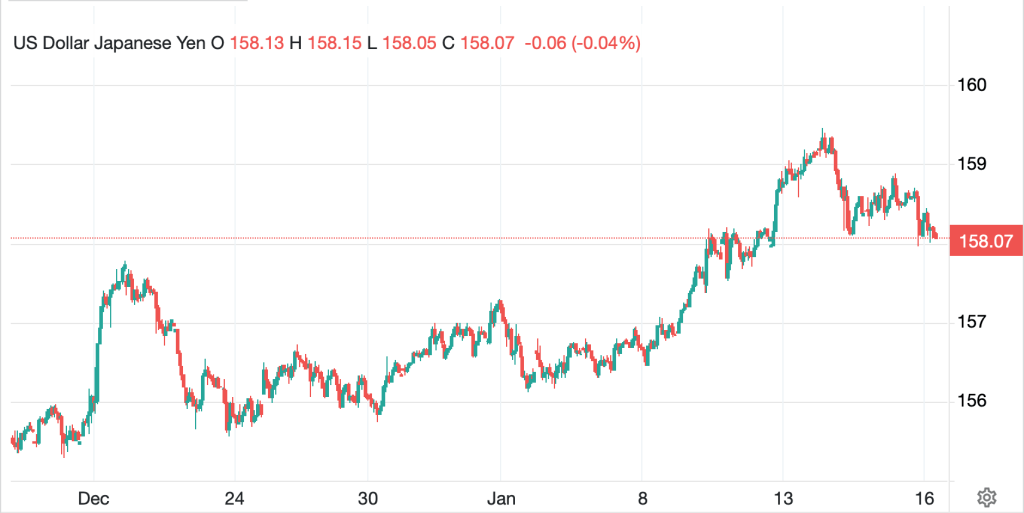

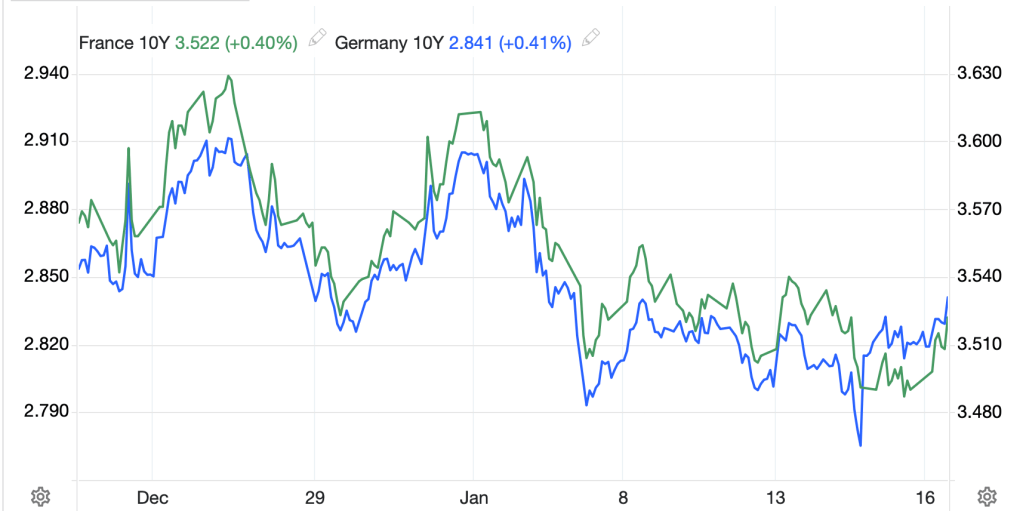

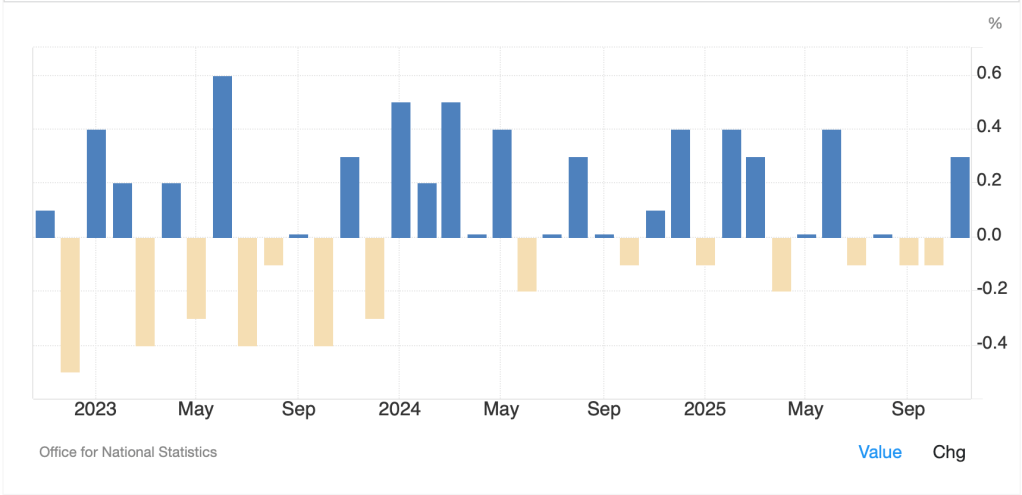

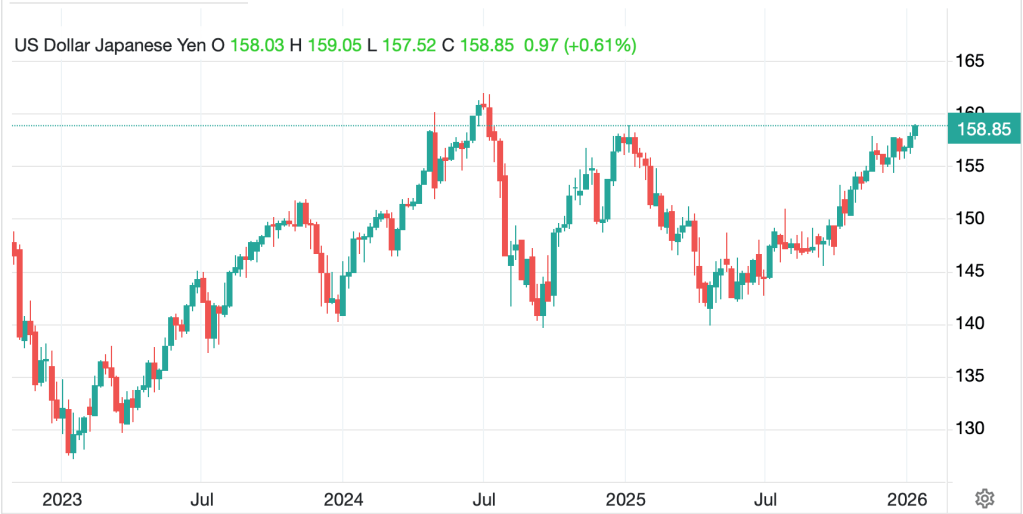

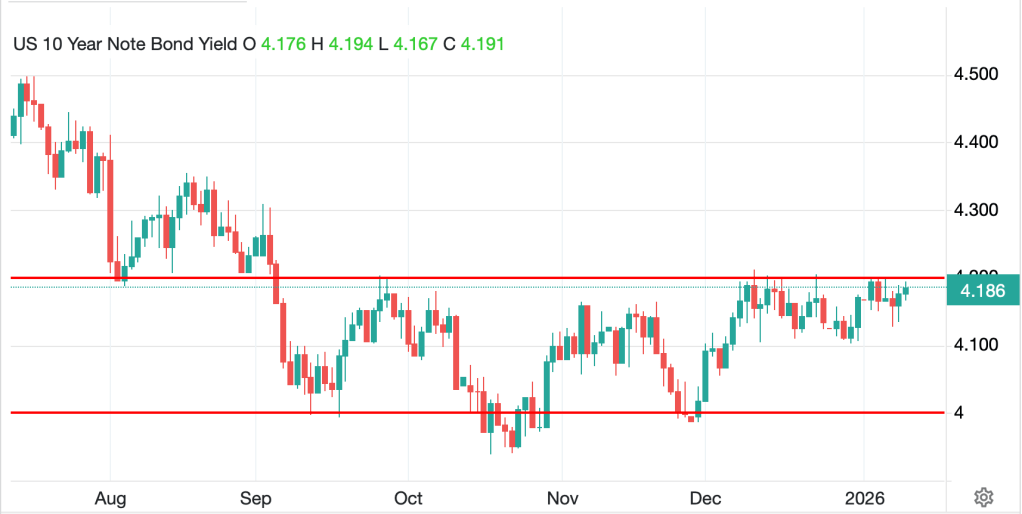

In the bond markets, apparently the end of the world has also been postponed. Yields declined yesterday and this morning, Treasury yields are unchanged at 4.24%. In Europe, yields have slipped -2bps to -4bps on the continent although UK gilts (+2bps) are bucking the trend, which appears to be an ongoing impact from yesterday’s higher than expected inflation data which continues to point toward stagflation in the UK. Interestingly, JGB yields (-4bps) have also fallen again, although they certainly remain near recent highs. PM Takaichi is going to formally dissolve the Diet tonight and the election is slated for February 8th (wouldn’t it be wonderful if US election campaigns were just 2 weeks long!). While nothing has changed in her fiscal planning, it seems that investors are awaiting the BOJ announcement tonight (no change expected) and have been modestly appeased by a substantial increase in exports although the trade surplus declined slightly.

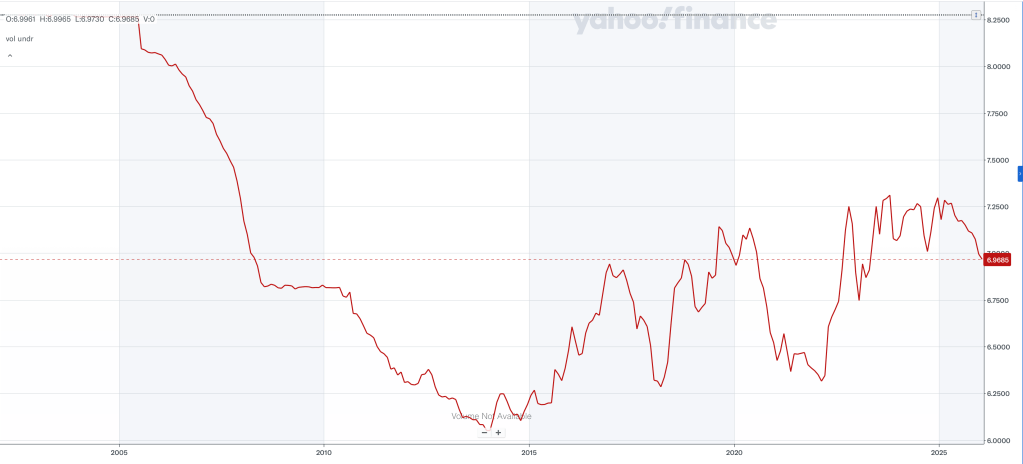

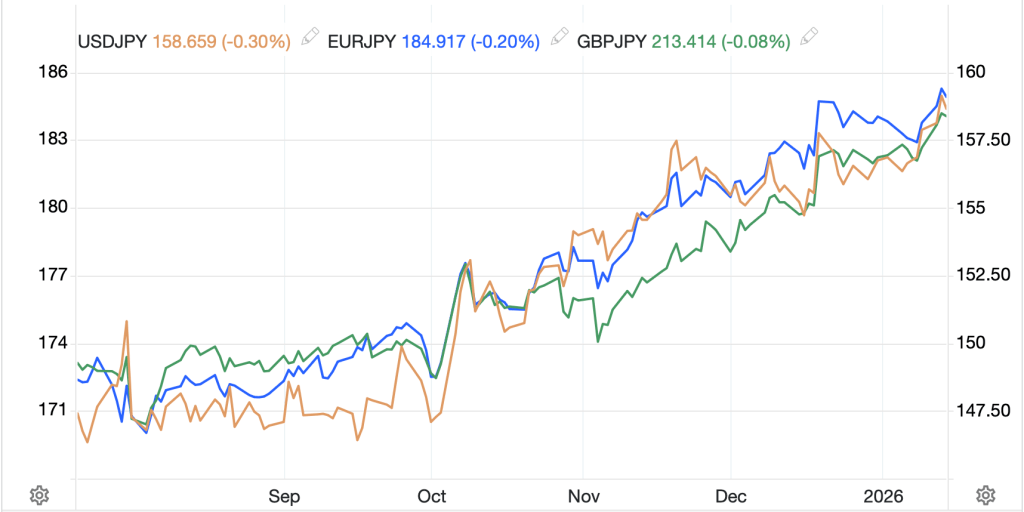

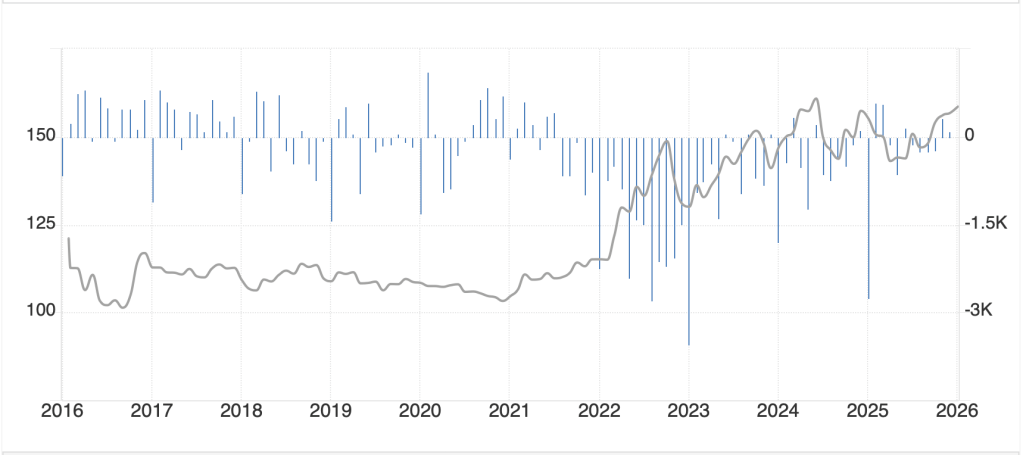

I think it is worth looking at the trade balance relative to the yen (-0.2%) as per the below chart. Recall, historically, Japan ran major trade surpluses, which was always one of the tensions between the US and Japan dating back to President Reagan. But as you can see below, the blue bars are the monthly trade numbers and since Covid, that situation changed dramatically.

Source: tradingeconomics.com

However, once the yen started to weaken substantially, the lagged effect showed up in trade data as can readily be seen above. In fact, this is the real tension in Japan, I believe, that the weak yen helps exports significantly, but has become an inflation problem and the government is caught between the two issues. This is why I believe we will see a weaker yen over time, especially if Takaichi-san comes out of the election with a solid majority.

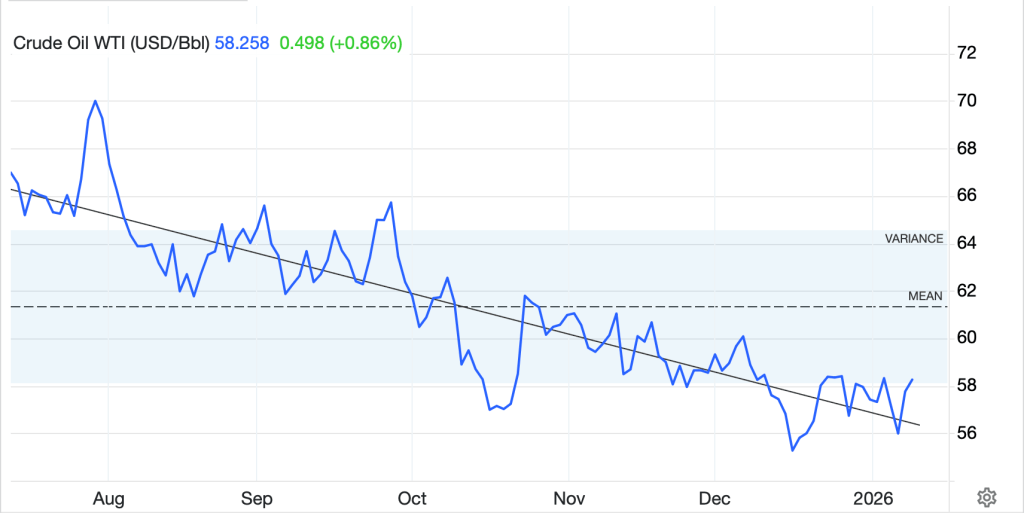

As I’m on currencies, if we look elsewhere, the dollar, although we have been constantly assured it was collapsing, remains in its trading range. This morning, the DXY (-0.1%) has edged lower after yesterday’s rebound. As it happens, yen weakness has been offset by modest euro strength, but the real strength is in the commodity space with NOK (+0.8%), SEK (+0.36%), AUD (+0.6%) and NZD (+0.6%) all having solid sessions. Now, my take is that the first two are more likely responses to the Greenland issue’s apparent resolution as NOK is rallying despite oil’s (-1.7%) sharp decline. Remember, both those nations were in the crosshairs of Trump’s mooted tariffs. On the other hand, last night, the employment situation in Australia perked up nicely which has helped raise market pricing for a rate hike by the RBA and given the strength in commodity prices and the apparent end of another global crisis, has helped support the currency. Ironically, as I scan the EMG space, movements there have been much smaller overall.

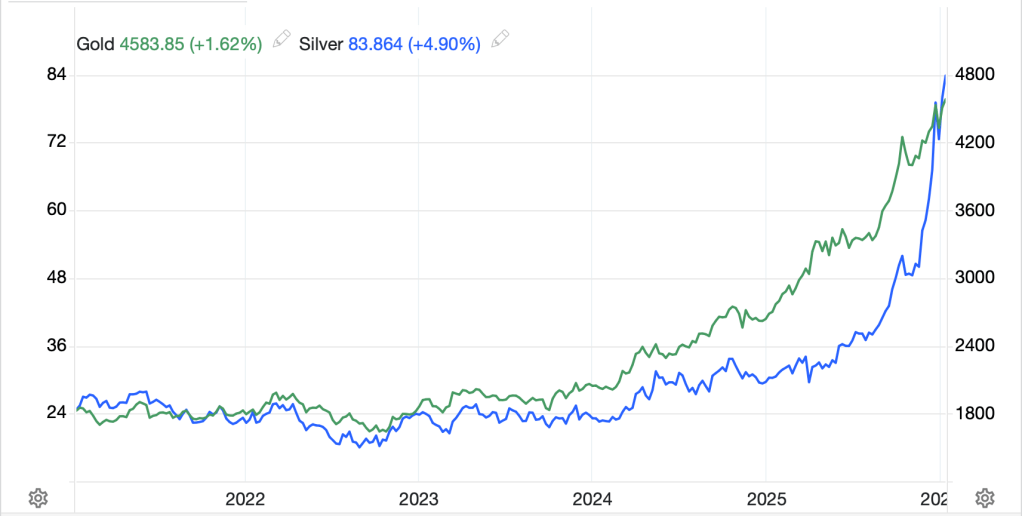

Finally, turning to the rest of the commodity space, for the first time in a week, gold is not higher this morning, but rather essentially unchanged. Silver (+0.25%) has bounced a tiny bit after selling off somewhat yesterday in NY. I have maintained that trees don’t grow to the sky, and frankly, the price action here appears tired regarding ever larger gains. I believe the fundamental story remains in place, but that doesn’t mean silver won’t chop around for a few weeks or months before starting higher again. Copper (-0.6%) is also under modest pressure this morning and has retreated much further, about -6.3%, from its recent highs at $6.10/lb than the precious metals. However, the red metal remains much in demand given the underlying electrification story.

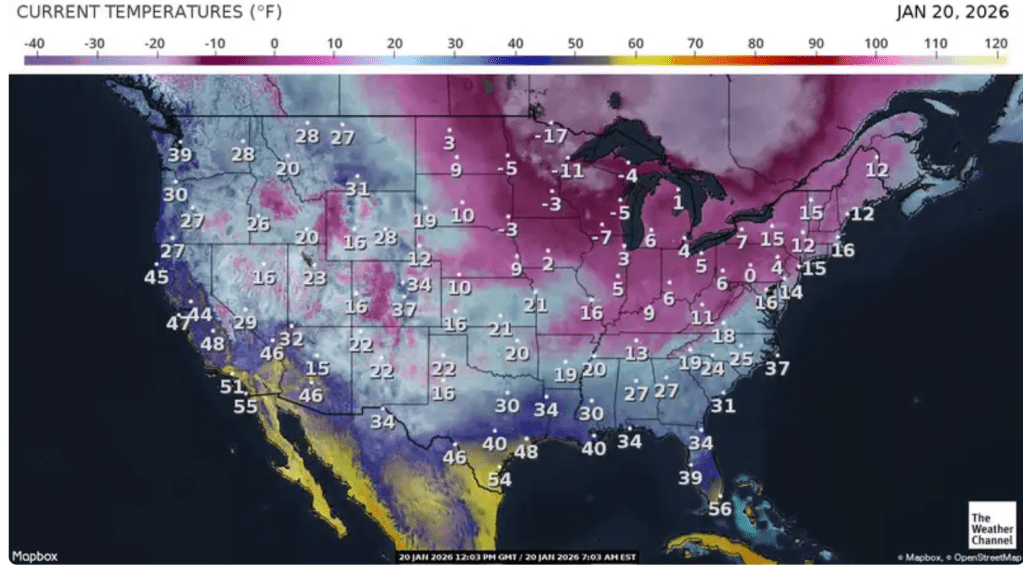

And lastly, a quick look at NatGas (+12%) shows what happens to commodity markets when there is the perception of insufficient supply for the current demand. This is higher by 75% this week! And while today in NJ, the temperature is a relatively balmy 34°, the forecast for the coming weekend is much colder and a huge snowfall. It’s not often you see a movement of this magnitude so here is the chart for the past month.

Source: tradingeconomics.com

On the data front, today brings the final look at Q3 GDP (exp 4.3%) as well as Initial (212K) and Continuing (1880K) Claims. Too, we get Personal Income (0.4%) and Spending (0.5%) for November and PCE (0.2%, 2.8% Y/Y) for both headline and core. The EIA releases its weekly oil inventory data today, a day later than usual because of the holiday Monday, with a modest build expected.

Market participants in all markets appear to have found a comfort zone and are taking risk positions again, at least for now. All the apocalyptic stories about the world rejecting the dollar and the rise of the BRICS will have to wait for another day. While I don’t know what the next situation is going to be, I am highly confident we are going to have another geopolitical scenario that is going to result in more screaming, teeth gnashing and pearl clutching by those who continue to believe the rules-based order is the way things should be. Alas for them, economic power and statecraft is the new world order, and my take is ultimately, the dollar benefits from this pivot.

Good luck

Adf