According to Jay and the Fed

The ‘conomy’s moving ahead

So, rates are on hold

With rallies in gold

And stocks and the dollar instead

But really, the thing that’s amazing

Is nobody cares about phrasing

Or Dot plots or pressers

‘Cause now all the stressors

Are Trump and commodities blazing

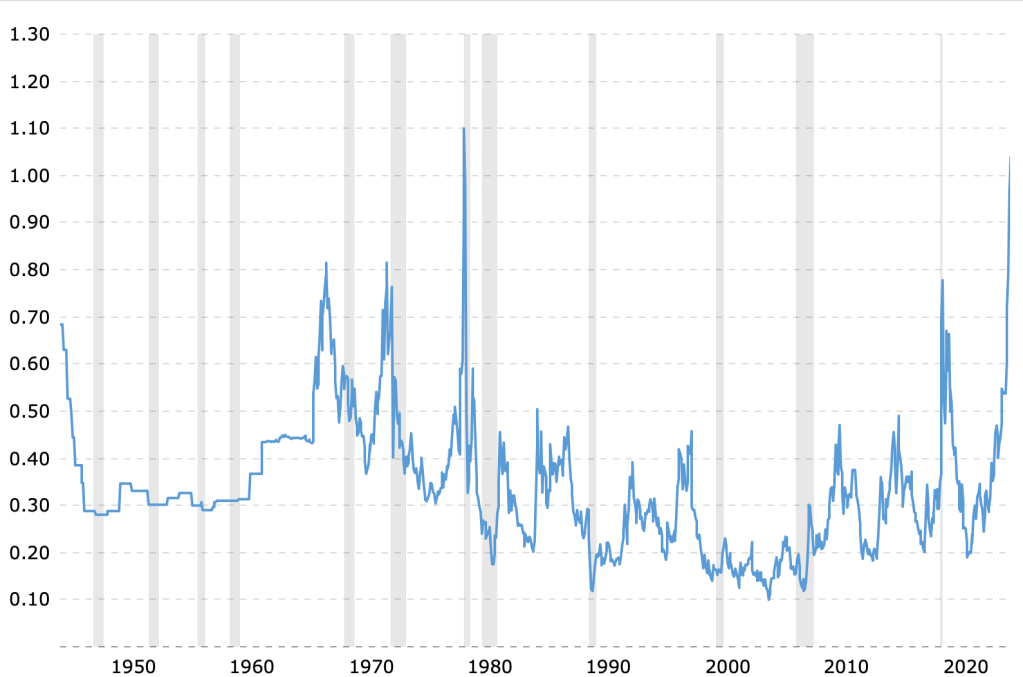

Once upon a time, the FOMC meeting was THE story for markets during the week leading up to the meeting and through the Chair’s press conference explaining the many virtues of what they did and why they did it. Of course, this has not always been the case. If we head back to the pre-Alan Greenspan days, the FOMC was peopled by 18 anonymous members and the Fed Chair, at that time Paul Volcker, and nobody ever spoke to the press and only grudgingly to Congress, they simply managed the money supply to the best of their ability to achieve their mandates. The biggest data point of every week was the Thursday afternoon M2 release, and there was an entire subculture of ‘Fed watchers’, similar to ‘Kremlin watchers’ whose job was to read the tea leaves based on market behavior and data in trying to determine how the Fed would behave going forward.

Almost the only time Chairman Volcker spoke in public was at the semiannual Humphrey-Hawkins testimony to Congress, but he basically never answered any questions and clearly didn’t care what either Senators or Congressmen asked.

But then we got the “Maestro”, Alan Greenspan, who after Black Monday in October 1987, created the first Fed put. At that time, the rest of the FOMC was still largely anonymous, but Greenspan craved the limelight, if only to try to show how much smarter he was than everybody else. Famously, he explained in Congressional testimony in 1996, “If you understood what I said I must have misspoken.” Greenspan was more available to the press than Volcker, but the rest of the committee remained in the background.

However, that simply set the table for the ensuing Fed chairs, Bernanke, Yellen and now Powell, all of whom give press conferences and clearly encouraged their minions to get out there and deliver the message. As so many struggling leaders explain, it’s not the substance, it’s the messaging that’s the problem. This is what we have all been dealing with since Bernanke sat down in 2006, mandated press conferences and pushed the narrative as a critical part of policy.

Then, along came President Trump’s second term, and times, they are a-changing. While Trump rails on Powell to cut rates and lambastes him regularly, it turns out, the combination of new fiscal and economic policy is driving monetary policy into the background, at least from the perspective of market participants. The result is that while FOMC members still get out there and give interviews regularly, they are never newsworthy. In fact, my suspicion is that the reason Chairman Powell made his little video announcing the Fed received subpoenas was as an effort to get back on the front page, a place he and his committee members have clearly grown to enjoy, and from which they are increasingly absent.

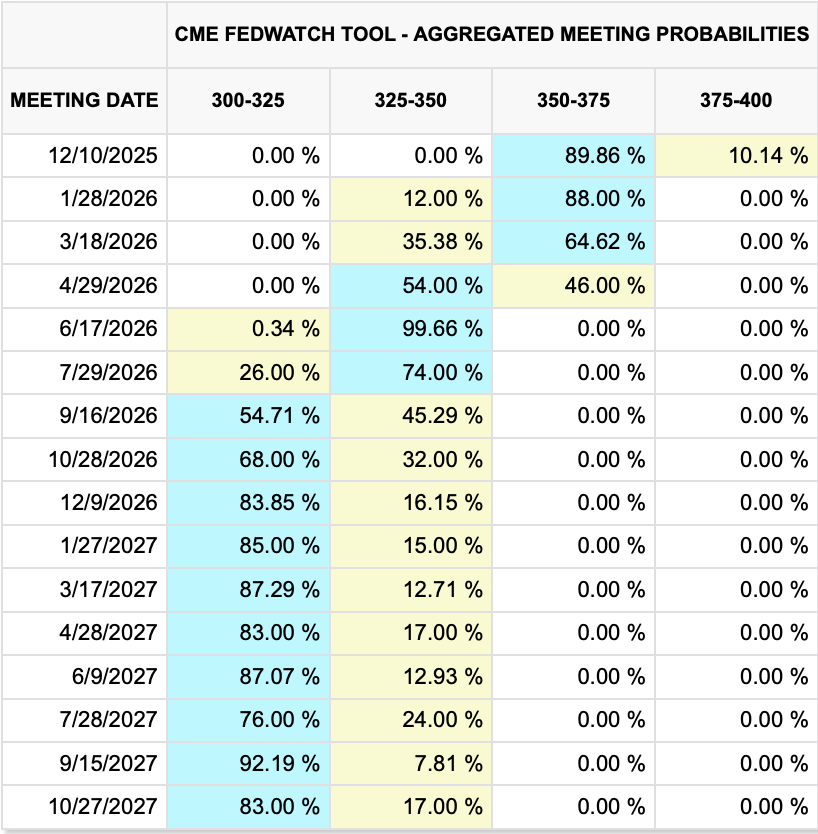

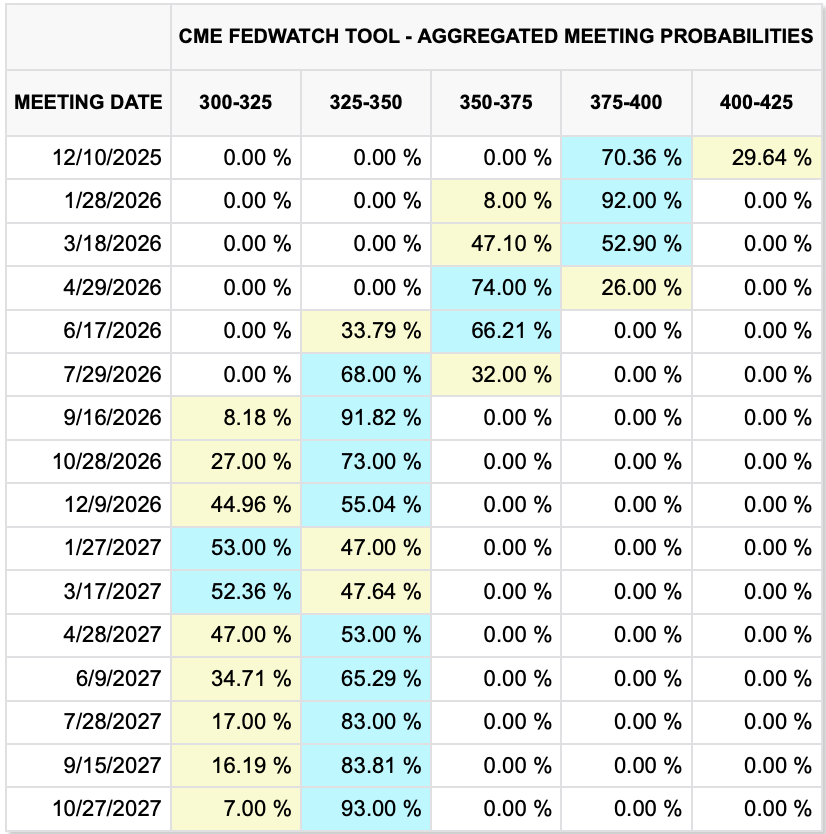

Which brings us to the meeting yesterday where…nothing happened. Policy rates remain unchanged, as universally expected, two voters wanted 25bp cuts (Miran and Waller), and they admitted that economic activity moved up from “moderate” to “solid”. In the most stinging rebuke, the market virtually ignored the entire process. In fact, the discussion about the next Fed chair is ebbing into the background. My take is this is a better situation for all involved. I only hope it stays this way.

So, what did happen? Stocks were flat, bonds were flat, the dollar rebounded a bit, and commodities continue to rocket higher. Let’s take a turn around markets overnight and start with commodities as that is where all the action is.

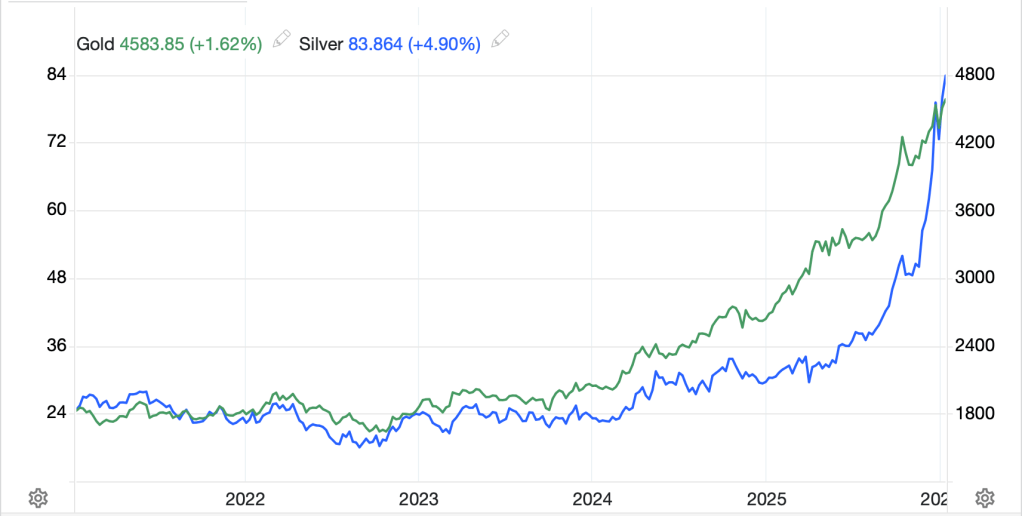

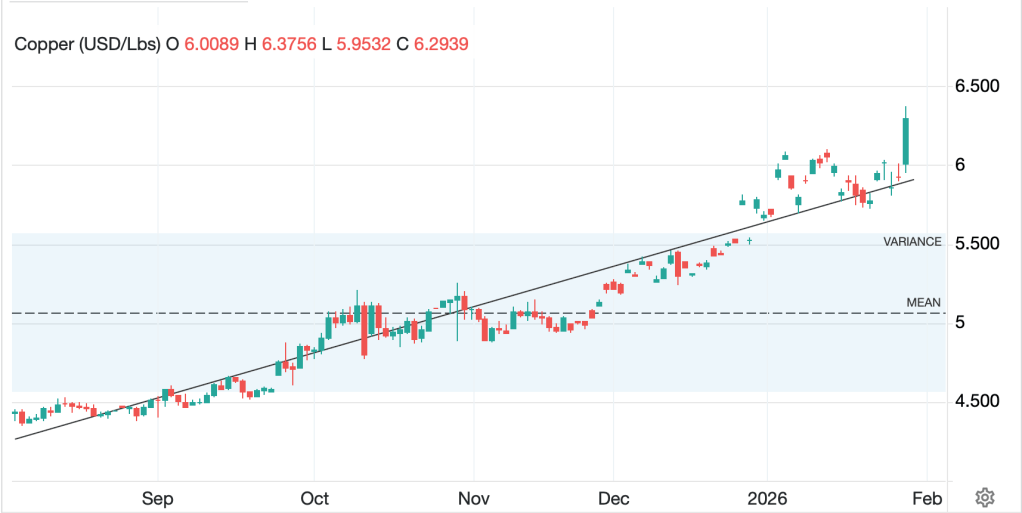

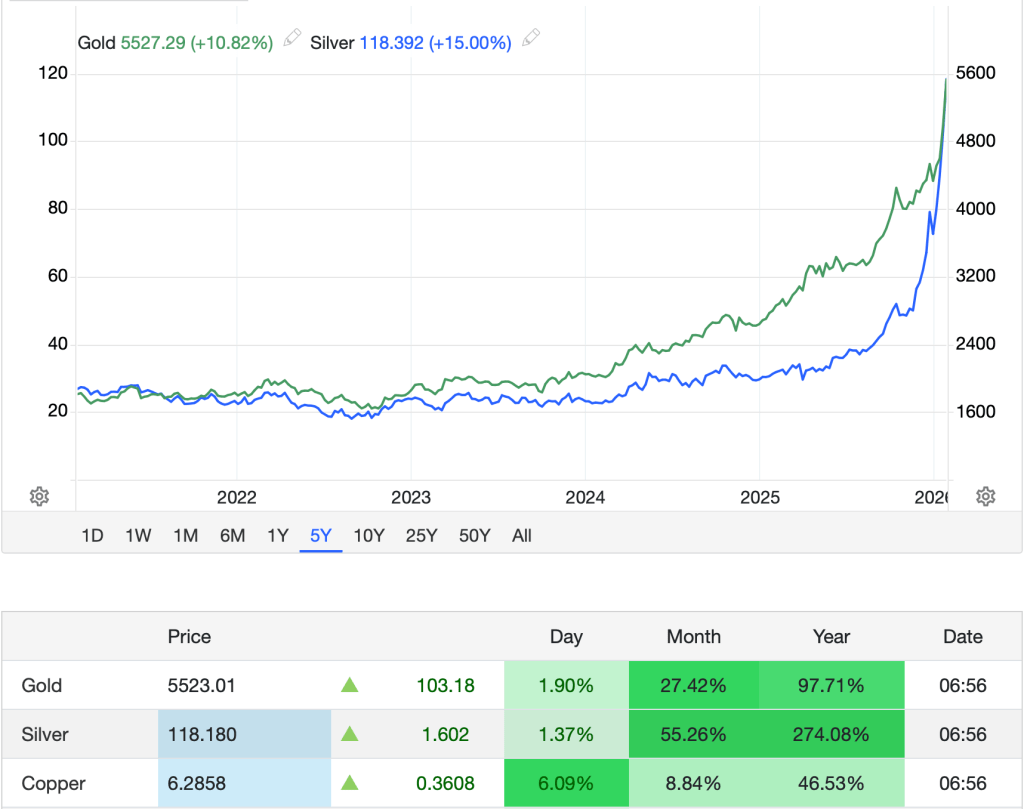

Copper (+6.1%) is the overnight star, soaring in Asia to record highs. As with virtually all commodities right now, blame is laid at the feet of the weakening dollar (it didn’t move overnight) and with uncertainties about President Trump’s next actions and the potential risks attendant to those actions when they occur. As we have seen with both gold (+1.9%, +27.1% in the past month) and silver (+1.3%, +54.6% in the past month), there is no doubt that fiat currencies are losing their status as a store of value, regardless of the interest rates they pay. While copper’s movement has not been as extraordinary as that of either gold or silver, the trend, as you can see in the chart below, remains clearly higher.

Source: tradingeconomics.com

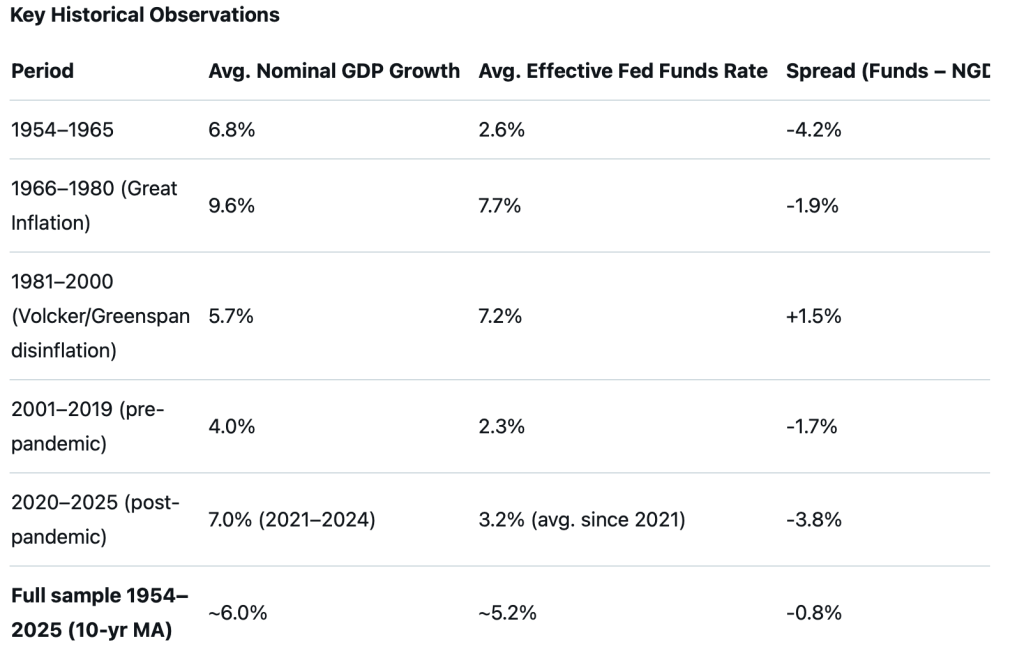

The underlying reality for all these metals is that the financialization of economies all around the world has resulted in far more market activity than was necessarily warranted by the physical markets. And physical markets need ounces and pounds of stuff, which have very long lead times to get out of the ground. As a trader, I look at these moves in precious metals and am very concerned they are overdone but as somebody with a basic understanding of physics, I see no reason to believe that the demand for these metals is going to slow down anytime soon. The below chart shows just how extraordinary the silver move has been, and the table below it really tells the tale.

Source: tradingeconomics.com

As to oil (+2.6%), it is heading higher this morning on increasing fears that the President is going to initiate a military action to depose the Ayatollah in Iran. Concerns are rising about Iran closing the Strait of Hormuz as well as its ability to respond via missile attacks. Remember, though, a market that moves on a political issue will revert once that issue has either occurred, or clearly won’t occur, so do not mistake this move for the beginning of a new trend. Consider what happened to oil after Russia invade Ukraine and after they invaded Crimea in 2014.

Source: finance.yahoo.com

Turning to the equity markets, yesterday’s US blahs were followed with a bit more price action in Asia as though Japan (-0.7%) slipped a bit, China (+0.8%), HK (+0.5%), Korea (+1.0%) and Taiwan (-0.8%) all so more significant movement, albeit not offering a larger theme given the relative gains and losses. Elsewhere in the region, the smaller exchanges showed more red than green. In Europe, Germany (-1.15%) is the dog, falling on idiosyncratic weakness in SAP and Deutsche Bank following weak earnings and forecasts, but the rest of the space is performing well (UK +0.4%, France +0.65%, Spain +0.4%) as earnings there have been relatively solid. And, at this hour (7:10), US futures are pointing higher by about 0.25% or so as earnings numbers have been strong so far this week, highlighted by Meta last night.

In the bond market, activity is less frenetic with Treasury yields unchanged this morning, European sovereigns catching a bit of a bid as yields slip -2bps across the board and JGB yields (+2bps) rising after the latest poll showing PM Takaichi increasing her odds of getting an LDP majority in the Diet next week. Something to watch closely going forward is the shape of the yield curve as there is growing concern that long-end rates may rise regardless of the Fed (yet another sign the Fed is losing its sway). In fact, I suspect if that is the case, that we will see yet another bout of QE, although they will find an alternate name.

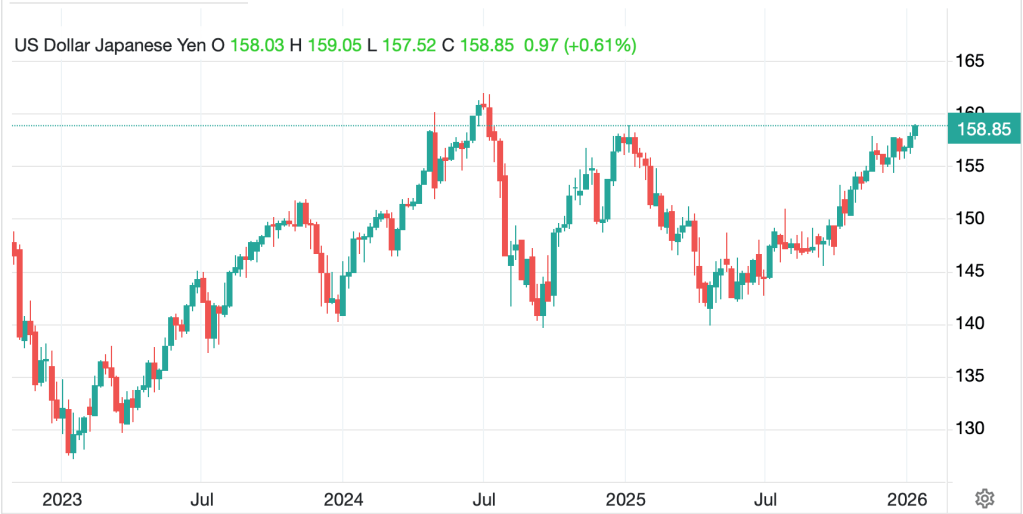

Finally, in the FX markets, despite all the pearl clutching about the end of the dollar, there is no movement of note in any currency today, with the entire screen showing gains or losses of 0.3% or less with one exception, CLP (+0.5%) following the remarkable jump in copper’s price. The linked article is quite funny as they explain all the negatives of a weak dollar and then also explain that ECB members are concerned about a too strong euro. I am frequently confused by whether a strong currency is good or bad for a nation, but I guess it depends on the narrative you are trying to push.

On the data front, weekly Initial (exp 205K) and Continuing (1860K) Claims come at 8:30 as does the Trade Balance (-$40.5B). We also see final Nonfarm Productivity (4.9%) and Unit Labor Costs (-1.9%) which if those numbers are met indicate quite positive economic activity. Then, at 10:00 we see Factory Orders from November (1.6%), but that is such old data I don’t think it matters.

Remember, it is Trump’s world (and Bessent) and we’re just living in it. The White House is the source of all the news so let’s all be happy that the Fed is fading into the background. With that in mind, based on President Trump’s goals, a weaker dollar is clearly his desire, at least in the short run, although I continue to see scope for longer term strength.

Good luck

Adf