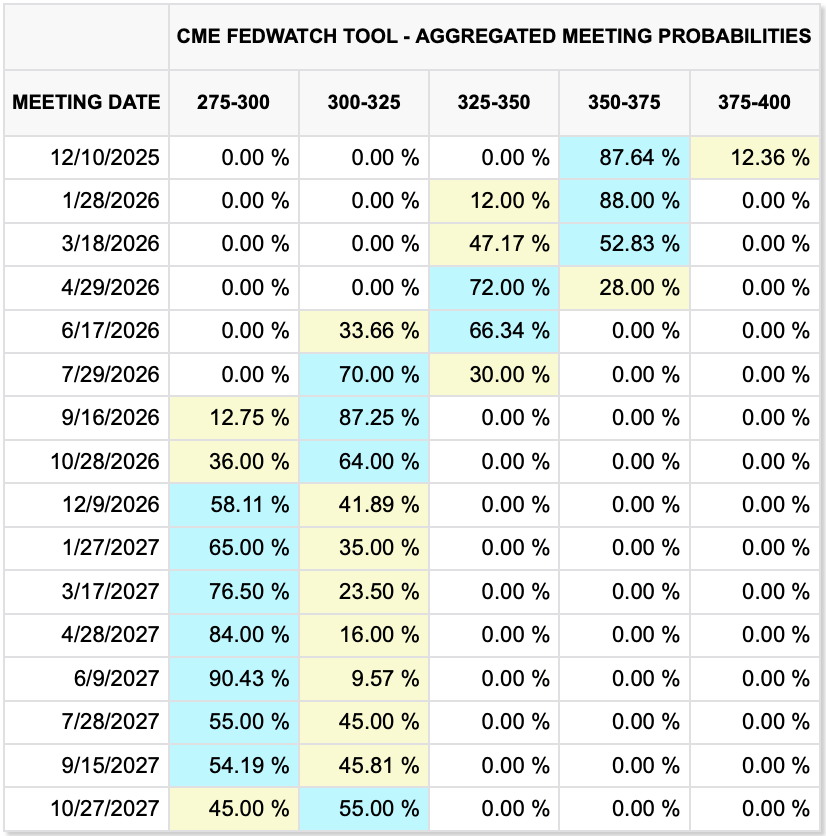

Though next week the Fed will cut rates

The bond market’s in dire straits

‘Cause nothing is clear

‘Bout growth, and Jay’s fear

Is he’ll miss on both his mandates

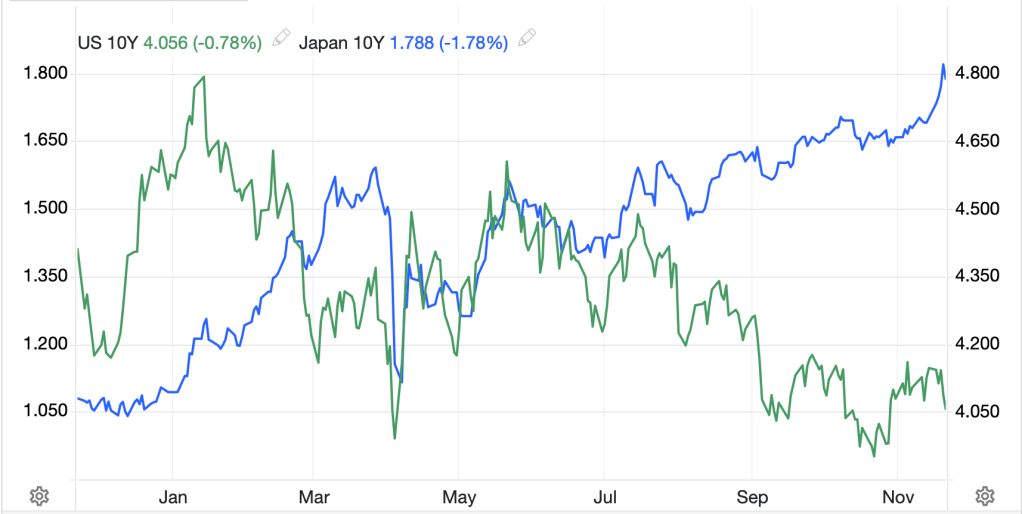

In the past week, 10-year Treasury yields have risen 13bps, as per the below chart, even though market pricing of a Fed rate cut continues to hover around 88%. Much to both the Fed’s and the President’s chagrin, it appears the bond market is less concerned with the level of short-term rates than they are of the macroeconomics of deficit spending, and total debt, as well as the potential for future inflation.

Source: tradingeconomics.com

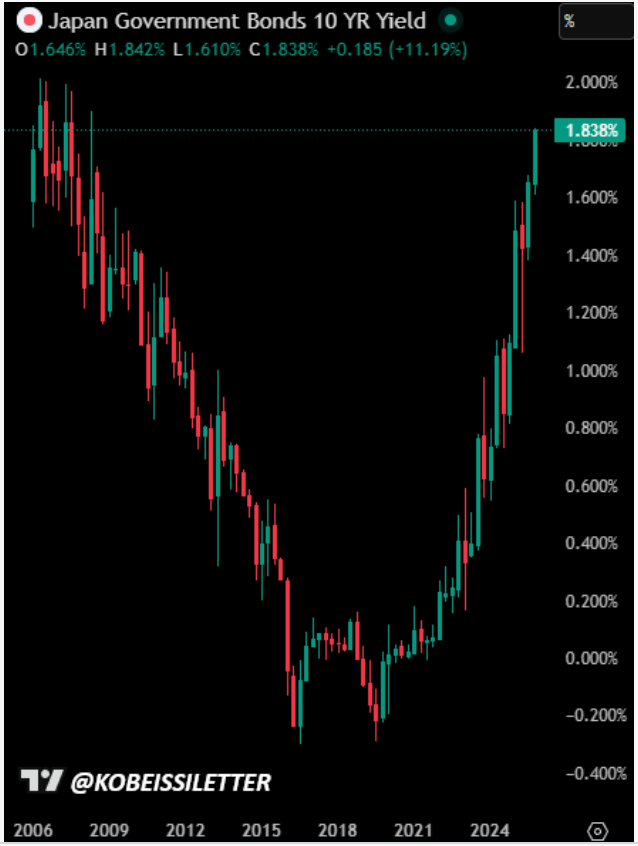

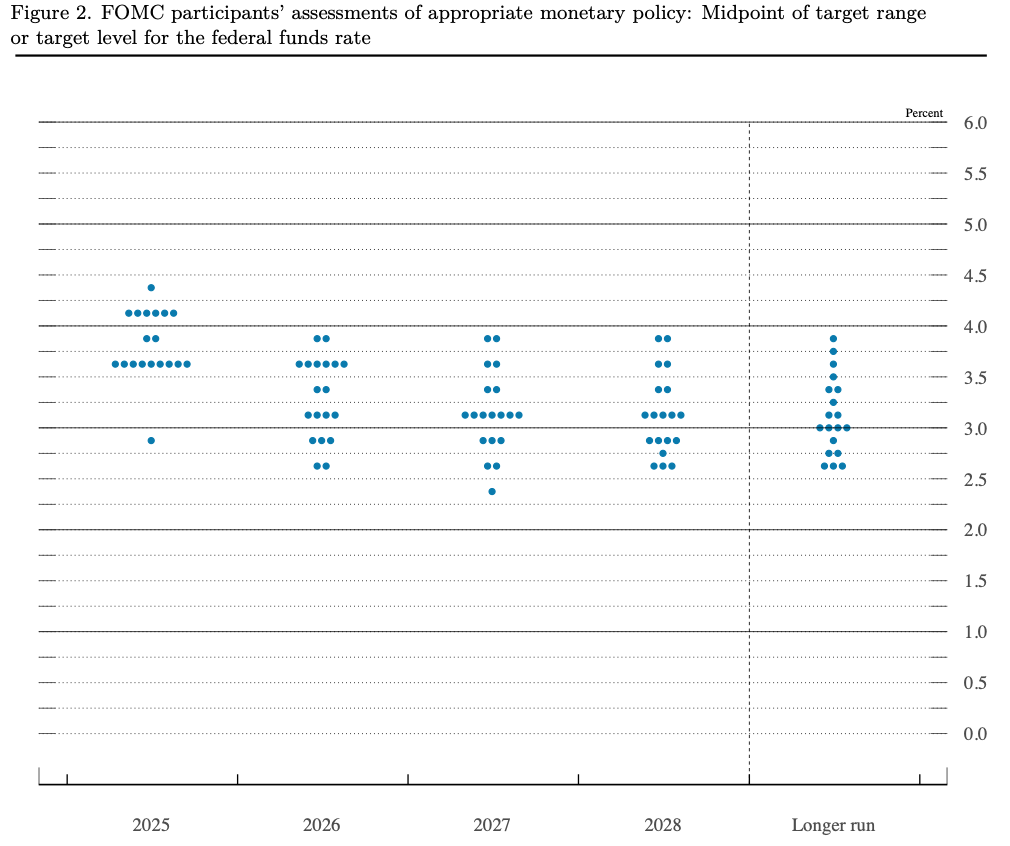

I don’t think it is appropriate to describe the current bond market as being run by the bond vigilantes, at least not in the US (Japan may be another story) but it is unquestionable that there is a growing level of discomfort in the administration. This morning, we will see the September PCE data (exp 0.3%, 2.8% Y/Y headline; 0.2% 2.9% Y/Y Core) which will do nothing to comfort those FOMC members who quaintly still believe that inflation matters.

It’s funny, while the President consistently touts how great things are in the economy, both he and Secretary Bessent continue to push hard for lower interest rates, which historically had been a sign of a weak economy.

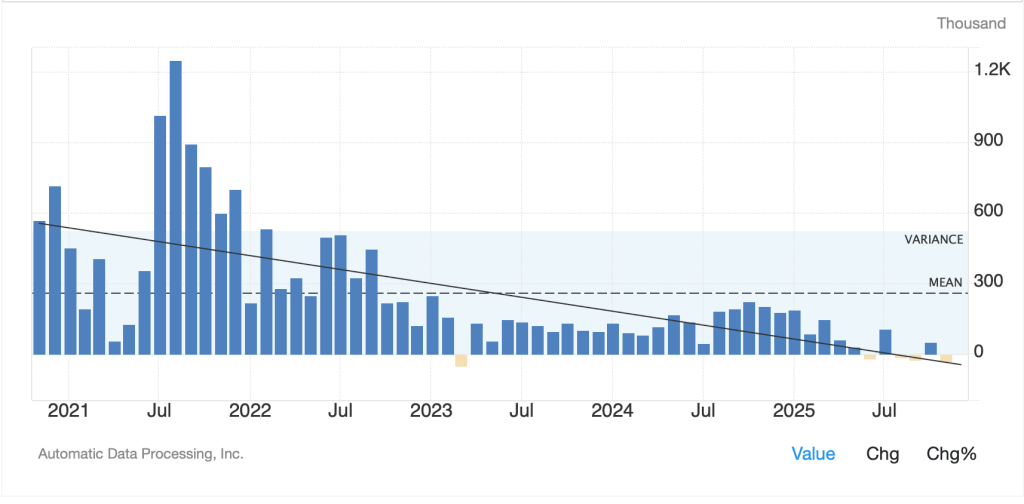

But as I have highlighted before, the data is so disparate, every analyst can find something to support their pet theory. For instance, on the employment front, the weak ADP reading on Wednesday indicated that small businesses were under pressure, yet the Initial Claims data yesterday printed at a remarkably low 191K, which on the surface indicates strong labor demand. Arguably, that print was impacted by the Thanksgiving holiday so some states didn’t get their data in on time, and we will likely see revisions next week. But revisions are not nearly as impactful as initial headlines. Nonetheless, for those pushing economic strength, yesterday’s Claims number was catnip.

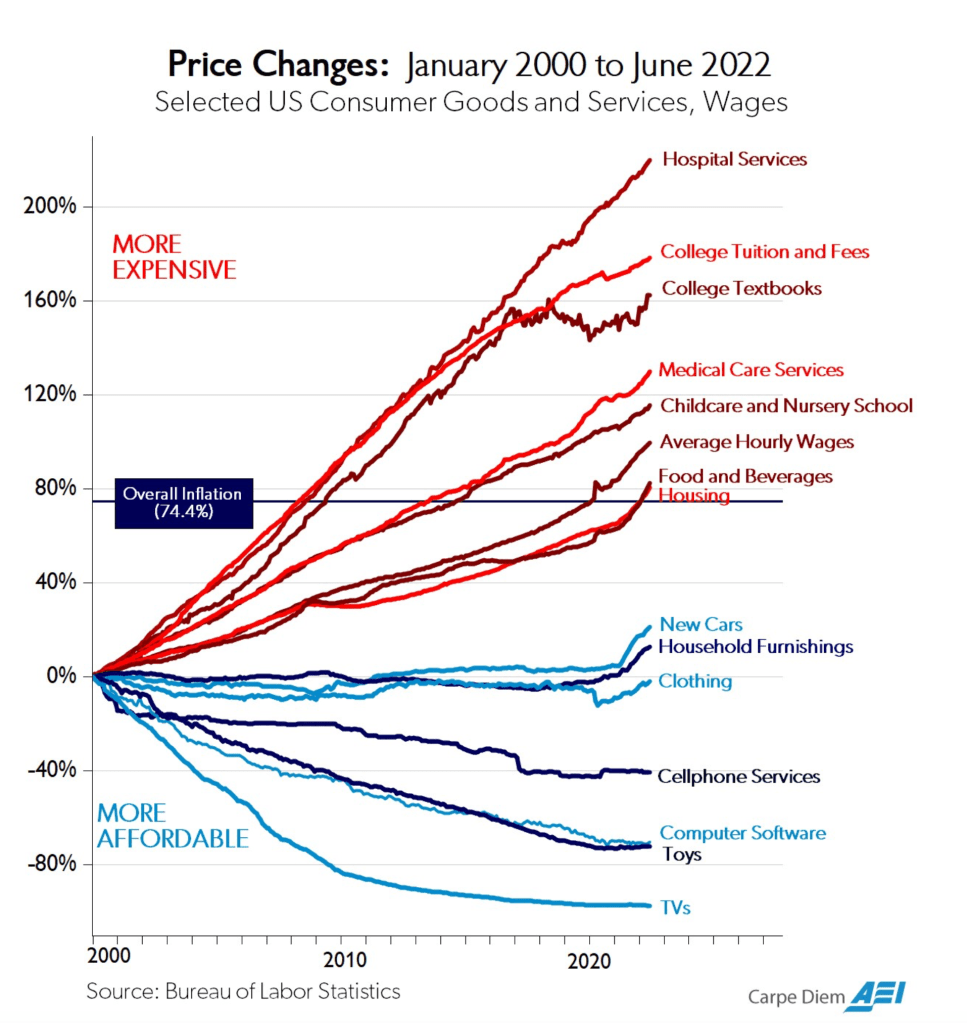

So, which is it? Is the economy strong or weak? My amateur observation is that we no longer have an ‘economy’ but rather we have multiple industrial and business sectors, each with its own dynamics and cycles, some of which are related but others which are independent. And so, similar to the idea that the inflation rate that is reported is an average of subcomponents, each of which can have very different trajectories than the others (as illustrated in the chart below), the economy writ large is exactly the same. So, an analogy might be that AI is akin to Hospital Services in the below chart while heavy industry is better represented by the TV’s line.

But, when we look at the Atlanta Fed’s GDPNow forecast below, it continues to show a much stronger economic impulse than the pundits expect.

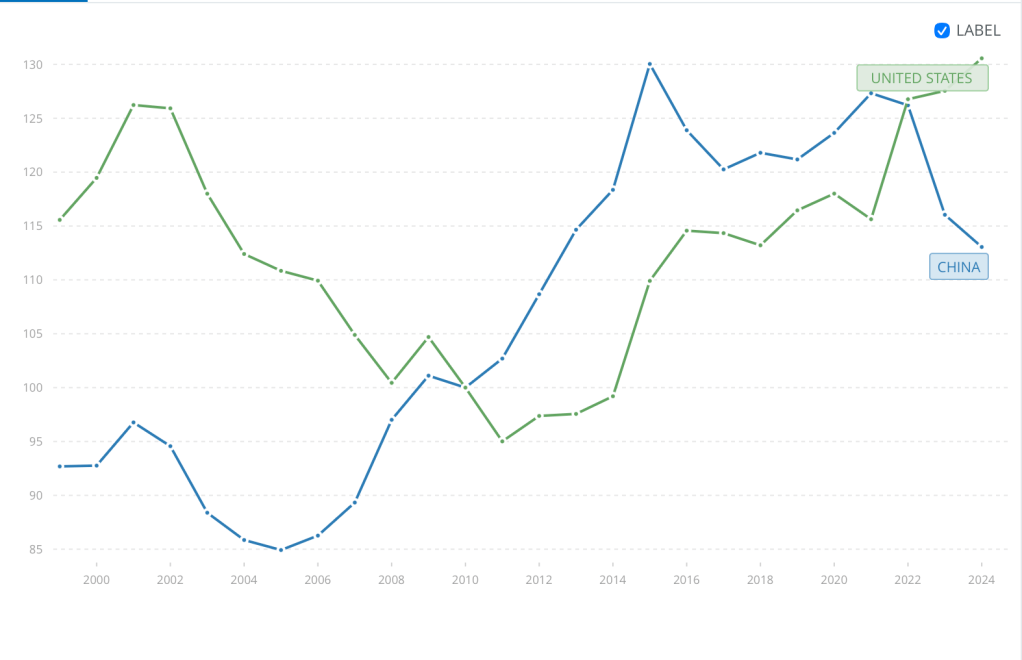

And quite frankly, if 3.8% is the real growth rate, that is quite strong, certainly relative to the last two decades in the US as evidenced by the below chart I created from FRED data. The orange line represents 4% and you can see that other than the Covid reopening, we haven’t been at that level for quite a while.

What is the reality? Everybody has their own reality, just like everybody has their own personal inflation rate. However, markets have been inclined to believe that the future is bright, which given my ongoing view of every nation ‘running it hot’ makes sense, so keep that in mind regardless of your personal situation.

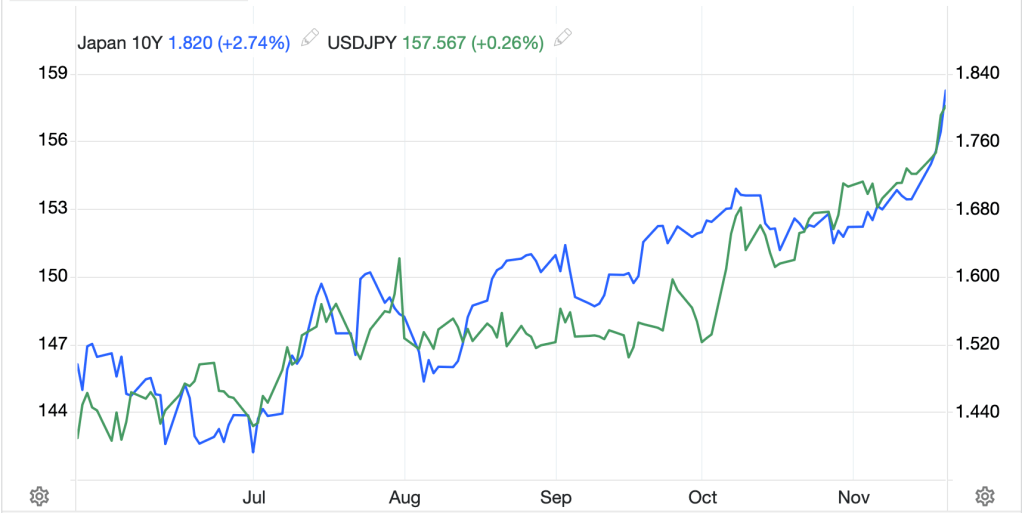

Ok, let’s look at how markets behaved overnight. Yesterday’s nondescript day in the US was followed by a mixed Asian session with Tokyo (-1.0%) slipping on concerns that the BOJ is going to raise rates. I’m not sure why that is news suddenly, but there you go. However, China (+0.8%), HK (+0.6%), Korea (+1.8%), India (+0.5%) and Taiwan (+0.7%) all continued their recent rallies. The RBI did cut rates by 25bps, as expected, but that doesn’t seem to have been the driver. Just good vibes for now.

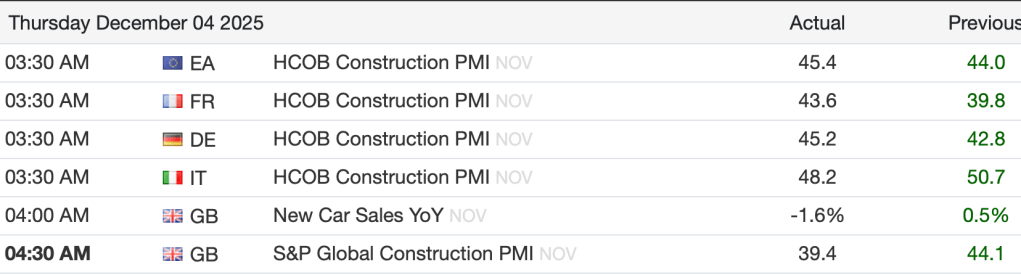

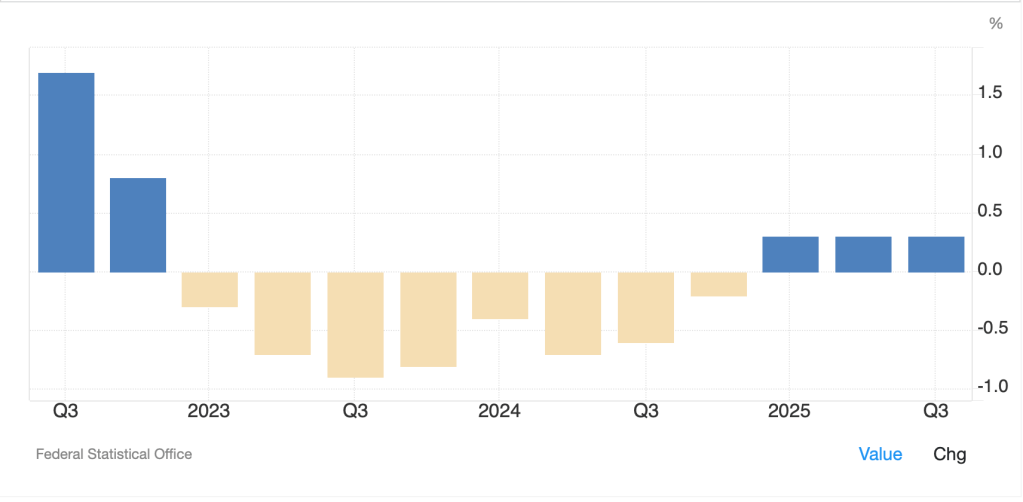

In Europe, screens are also green this morning, albeit not dramatically so. Frankfurt (+0.6%) leads the way but Paris (+0.3%), Madrid (+0.2%) and London (+0.1%) are all on the right side of the ledger. Eurozone growth in Q3 was revised up to 0.3% on the quarter, although that translated into an annual rate of 1.4%, lower than Q2, but the positive revision was enough to get the blood flowing. That and the idea that European defense companies are going to come back into vogue soon. And as has been their wont, US futures are higher by 0.2% at this hour (7:35).

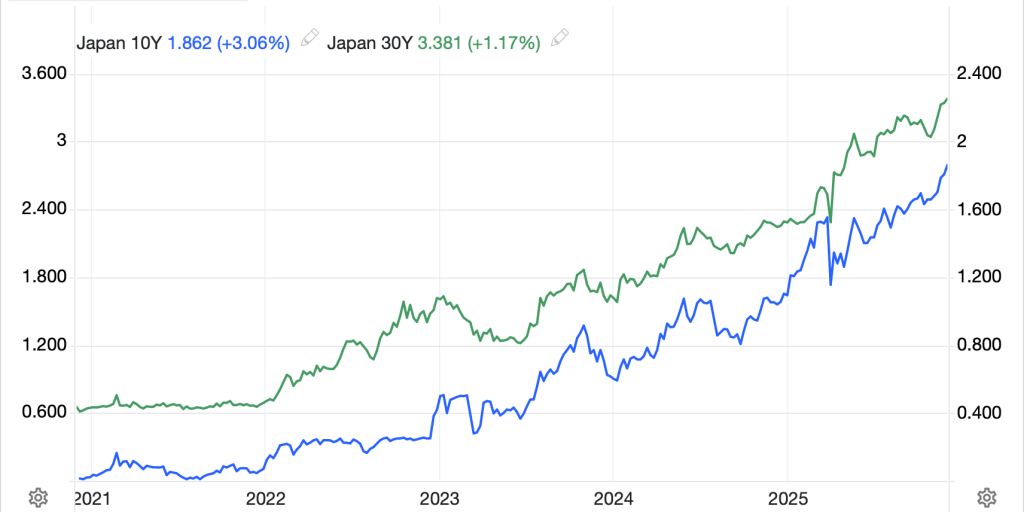

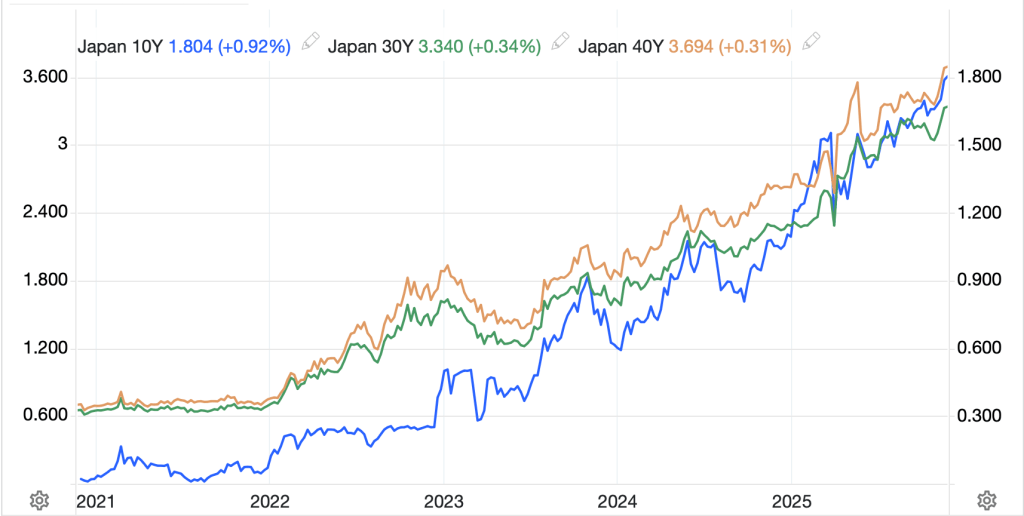

In the bond market, Treasury yields are higher by 2bps this morning and European sovereign yields are getting dragged along for the ride, up 1bp to 2bps across the board. JGB yields also continue to climb and show no sign of stopping at any maturity. A BOJ rate hike of 25bps is not going to be enough to stop the train of spending and borrowing in Japan, so I imagine there is much further to go here.

In the commodity space, silver (+1.8%) has been getting a lot more press than gold lately as there are ongoing stories about big banks, notably JPM, having large short futures positions that were designed to keep a lid on prices there, but the structural shortage of the metal has started to cause delivery questions on the exchanges all around the world. So, while it has not yet breached $60/oz, my take is that is the direction and beyond.

Source: tradingeconomics.com

Gold’s (+0.4%) story has been told so many times, it is not nearly as interesting now, central bank buying and broader fiat debasement concerns continue to be the key here. Copper (+1.8%) is also trading at new highs in London and the demand story here knows no bounds, at least not as long as AI and electrification are part of the mix. As to oil (-0.25%), it is a dull and boring market and will need to see something of note (regime change in Venezuela or peace in Ukraine seem the most likely stories) to wake it up.

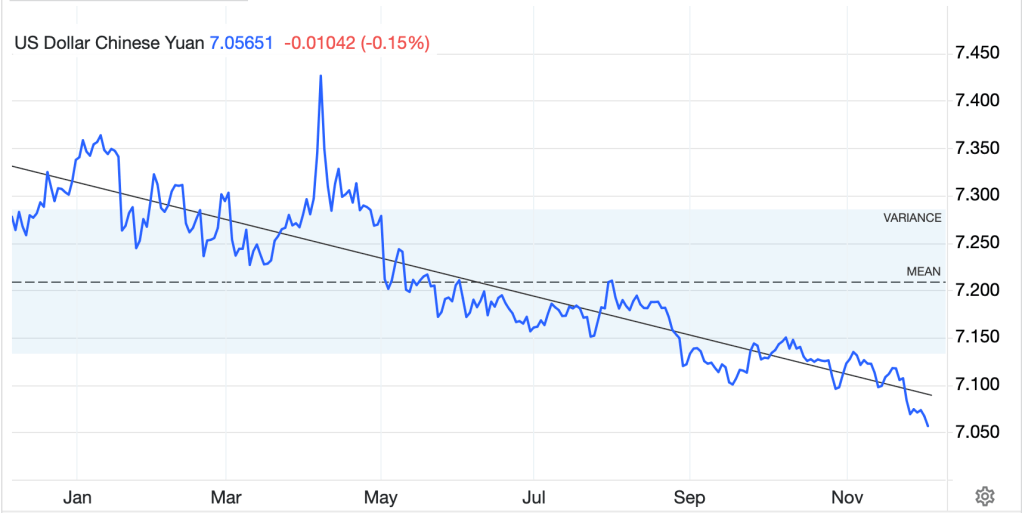

Finally, the dollar is still there. The DXY is trading at 99, below its recent highs but hardly collapsing. Looking for any outliers today ZAR (+0.4%) is benefitting from the gold rally (platinum rallying too) but otherwise there is nothing of note. INR (-0.2%) continues to trade around its new big figure of 90.00, but has stopped falling for now, and everything else is dull.

As well as the PCE data, we get September Personal Income (exp 0.3%), Personal Spending (0.3%) and Michigan Sentiment (52.0) with only the Michigan number current. We are approaching the end of the year and while with this administration, one can never rule out a black swan, my take is positions are being lightened up starting now, and when the December futures contracts mature, we may see very little of interest until the new year. In the meantime, nothing has changed my big picture view. For now, absent a very aggressive FOMC cutting rates, the dollar is still the best of a bad bunch.

Good luck and good weekend

Adf