(With apologies to Clement Clarke Moore)

Tis the first day of trading in Ought Twenty-Six

With too much attention on raw politics

At home, eyes have turned to the mid-term elections

To see if results will force mid-course corrections

In Europe, they’re going all-in on Ukraine

With more billions promised, though that seems insane

Meanwhile, Mr Xi is convinced he can fix

The problems at home with his policy mix

And this, my friends, just skims the surface of things

As pols everywhere suffer arrows and slings

Remember, though, markets are what I’m about

And while I could err, I am never in doubt.

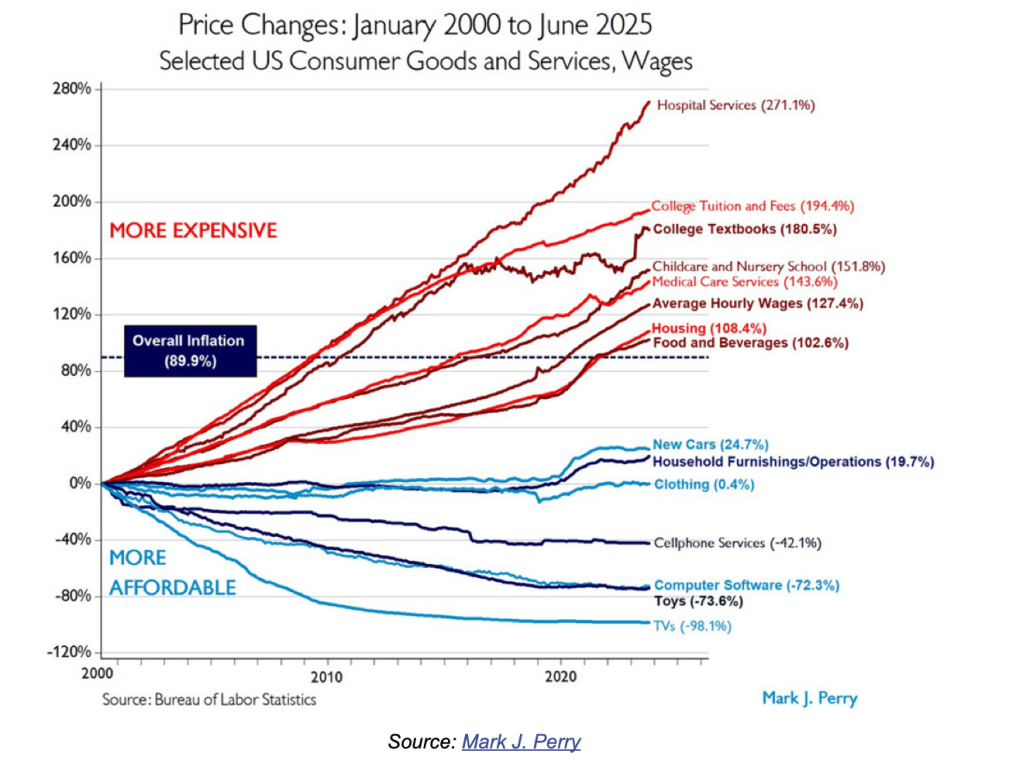

Let’s start at the top with Growth here in the States

Which likely will show more than marginal rates

In fact, Four percent seems a viable goal

As inward investment and tax cuts take hold

Remember, for Trump, if there’s one thing he’s not

It’s timid, and so he’ll demand, “Run it hot!”

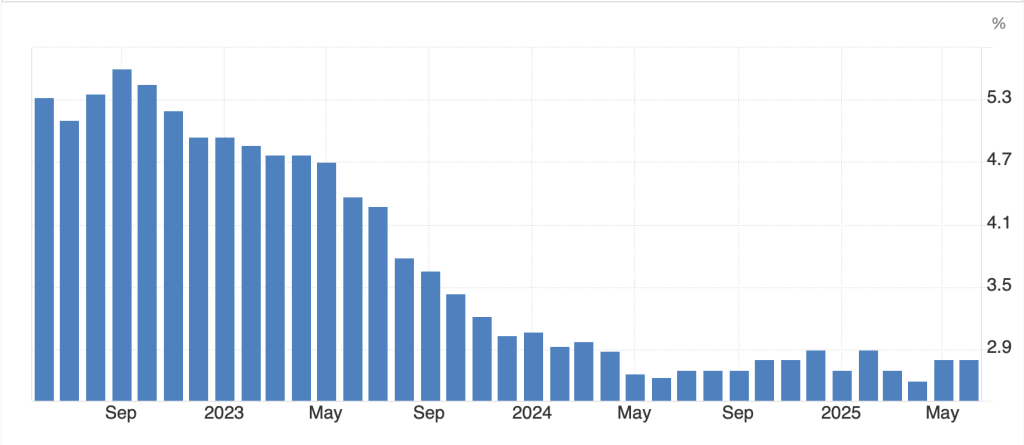

Thus, growth will expand, though inflation might gain

And for the elections, that could be a pain

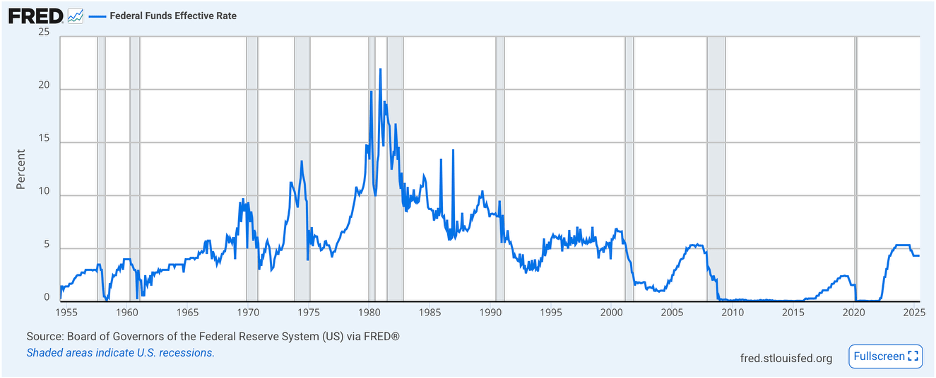

The problem is Jay, and whoever comes next

Have come to believe two percent’s just subtext

The greatest unknown is on government spending

And whether it grows or, at last, starts descending

The punditry’s certain the government fisc

Is going to increase inflation’ry risk

If true, CPI of near Four percent’s apt

If not, then Inflation ‘neath Three, could be capped

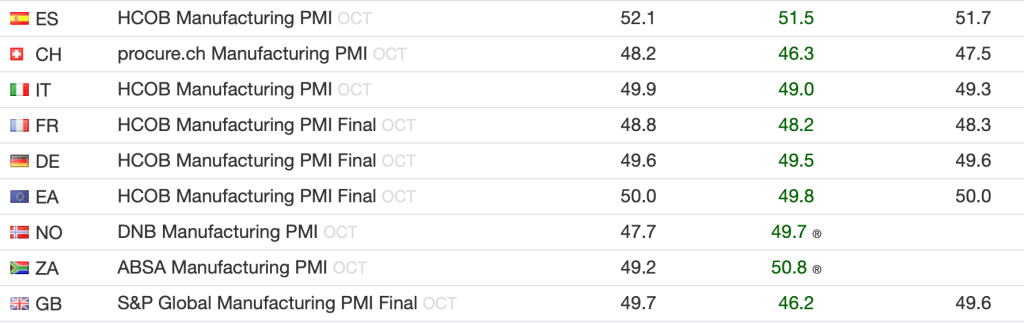

And what about elsewhere, in Europe? Japan?

In markets, emerging, do they have a plan?

Will they grow their ‘conomies, drawing investment?

Or will we soon witness a large reassessment?

In Europe, they claim they’ll be building more guns

To help them defend all their daughters and sons

As well, they’re committed to helping Ukraine

Continue to fight, despite so many slain

They’re planning to borrow a cool 90 Bill

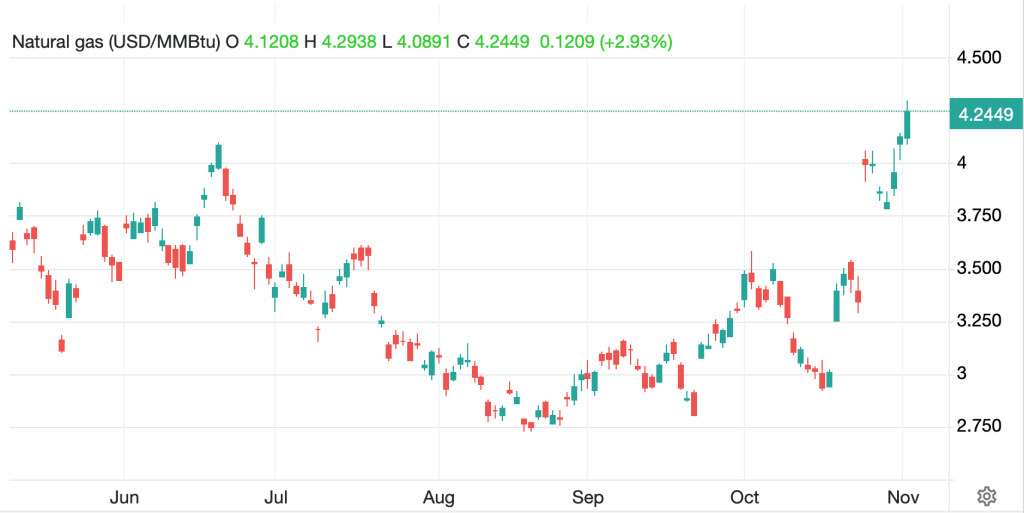

But energy costs, these grand plans could well kill

Meanwhile, M Lagarde claims that rates are just right

And given growth there’s One Percent, I won’t fight

So, weak growth and low rates and energy blues

Lead me to believe that come year-end, the news

Will be that the Euro is failing to thrive

Do not be surprised when it hits One oh-Five

In England and Scotland and all the UK

Just like in the EU, they can’t make much hay

The budget’s a wreck yet they want to raise taxes

Though history shows growth will wane ere it waxes

As well, they continue their crack down on speech

While crimping their energy industry’s reach

So, power is costly, and billionaires flee

From here, ‘cross the pond, this is what I foresee

A ‘conomy heading right into stagflation

As long as Kier Starmer is leading the nation

For markets, the Pound will lose all its allure

With One-Ten the Boxing Day screen price du jour

A turn to the East where the Sun Also Rises

Will teach us that, really, there are no surprises

To date you’ve heard much ‘bout the rise in yen rates

With pundits opining the Carry Trades’ fates

This year, so they say, look for much stronger yen

As local investors buy yen bonds again

Thus, all the hedge funds who’ve been funding their trades

By borrowing yen, and they’ve done so in spades,

Will need to buy back all that Japanese Money

The outcome, for yen shorts, will not be so sunny

But what if this idea of yen heading home

Is wrong? This implies quite a different syndrome

At this point there’s no sign the government there

Is ready, more spending and debt, to forswear

Instead, what seems likely is more of the same

More government spending in all but its name

So, debt will continue to rise without end

And up to One-Eighty the buck will ascend

As well as Japan, in the continent vast

Of Asia, it’s China we come to at last

“Poor” President Xi has a problem at home

Consumption is not in the Chinese genome

For decades, the model’s been, build and export

Which helps explain why local usage falls short

But lately the rest of the world’s of a mind

That Chinese imports are a troublesome kind

So, Xi needs his people to learn how to spend

Else all that production may come to an end

But if they consume, what will that do to growth?

Its rate will decline, something for which Xi’s loath

Thus, GDP 5 means a weaker yuan

Well above Seven you can depend on

But if, against odds, Xi gets Chinese to spend

Six-Fifty is where yuan will be at year end.

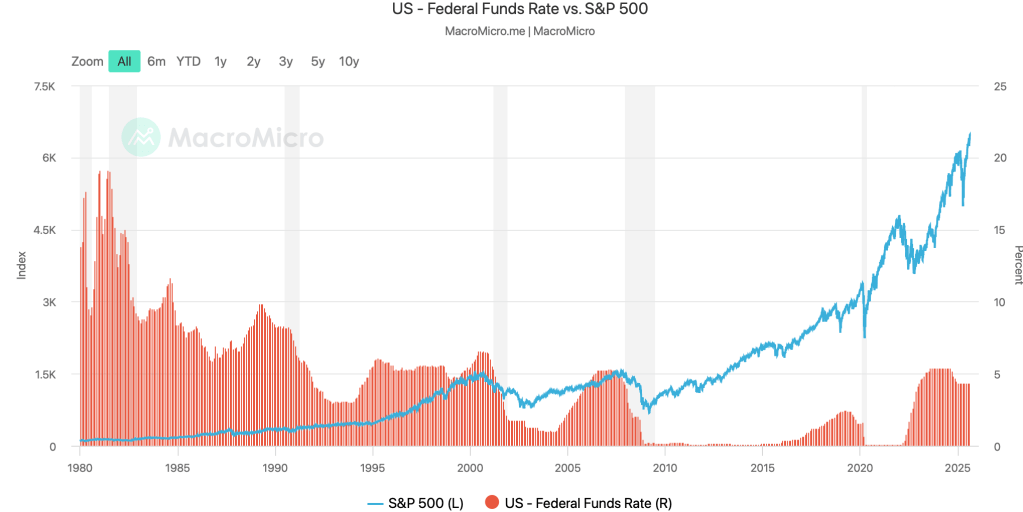

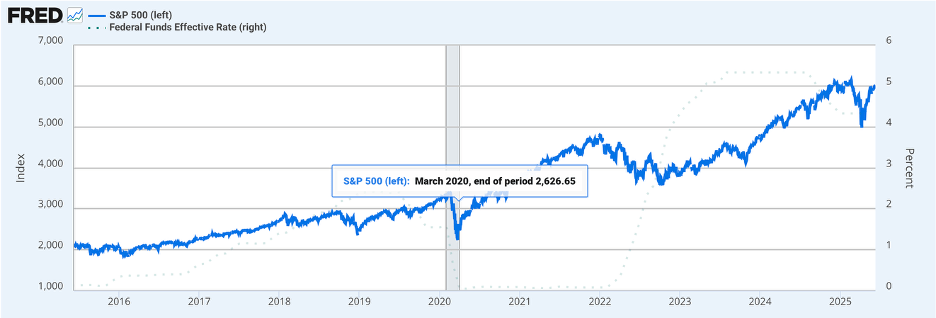

Let’s shift our perspective to Treasury debt

A market of critical import, and yet

A market that’s been in a range for a while

So, what must occur for a change in profile?

The popular view is that deficit spending

Will drive an outcome of, high yields, never-ending

But Trump and his team are, quite hard, pushing back

Explaining that policy’s on the right track

Twixt tariffs and growth, tax receipts have been flying

While RIFs in the government are underlying

The idea that deficits soon will be shrinking

In truth, this is not what the punditry’s thinking

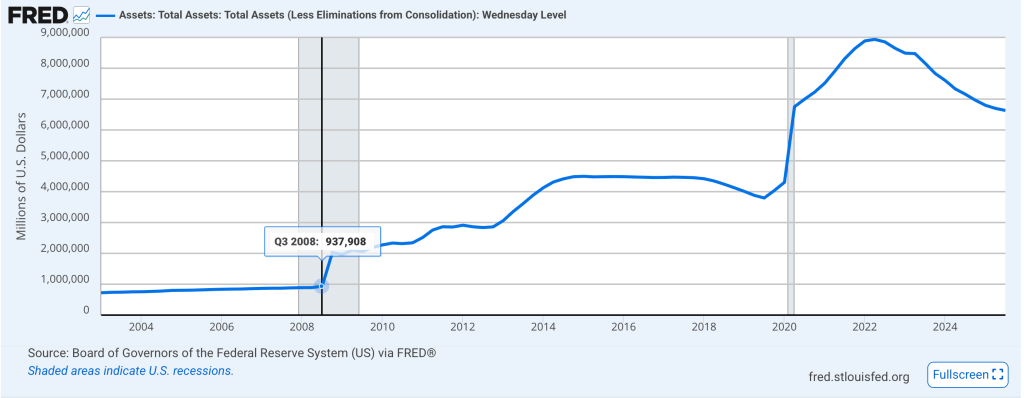

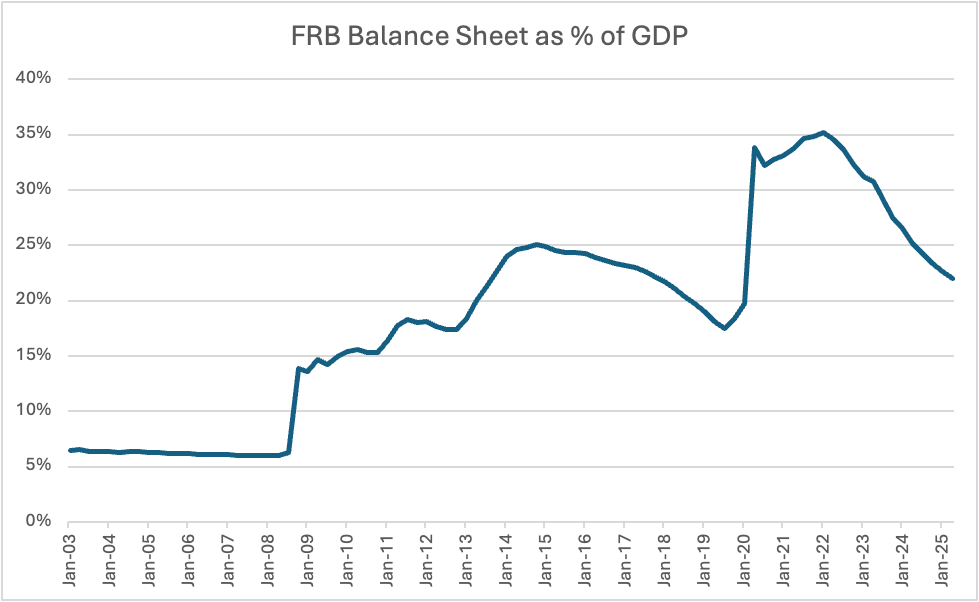

But one thing is clear that will keep yields from climbing

QE, which is back, is designed for pump-priming

So, Jay and his heir will keep buying and buying

And 10-Years at Four Percent seems satisfying

It’s not just the government, though, that’s in debt

Those corporates who borrowed at ZIRP, have not yet

Refinanced the trillions they owe, to this day

And now they’re competing with Bessent and Jay

While Scott will find buyers, if not least the Fed

For corporates that path may be flashing bright red

If credit spreads widen will companies fail?

And will that unravel the stock markets’ tale?

Right now, spreads for IG sit near one percent

And Junk’s above eight with investors content

However, the biggest risk this year could be

The absence of corporate debt liquidity

If IG spreads widen 200 bps more

The outcome could be a GFC encore

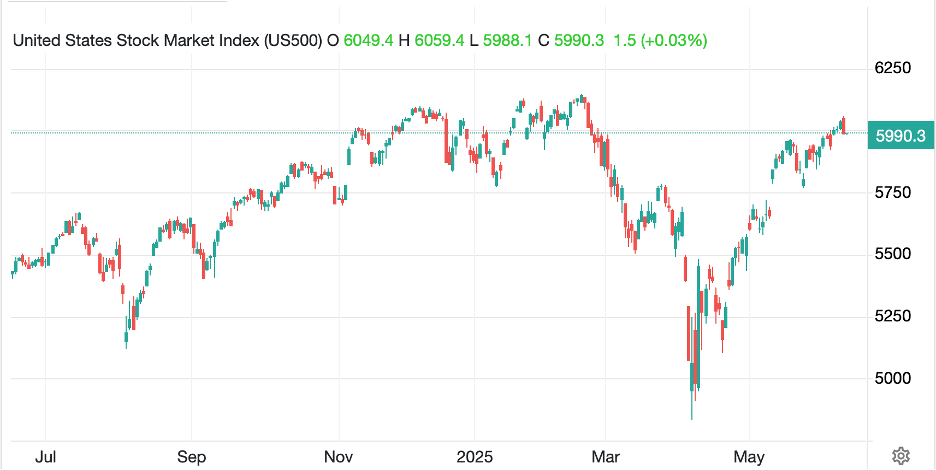

This takes us to stocks, both at home and abroad

Which last year saw rallies we all did applaud

But will this year bring us some more of the same?

Or have things been altered? Is there a new game?

If my crystal ball is in any way clear

The outcome could well be a frightening year

Remember, the driver of last year’s returns

Was government spending which lacked all concerns

Thus, Cantillon nailed it with where cash would go

And stocks were the winner, of that much we know

But this year the mountain of debt coming due

Could well force decisions of what will ensue

And too, don’t forget if the deficit shrinks

It’s likely to be a great stock market jinx

So, don’t be surprised if December this year

A 10% fall ‘cross all stocks does appear

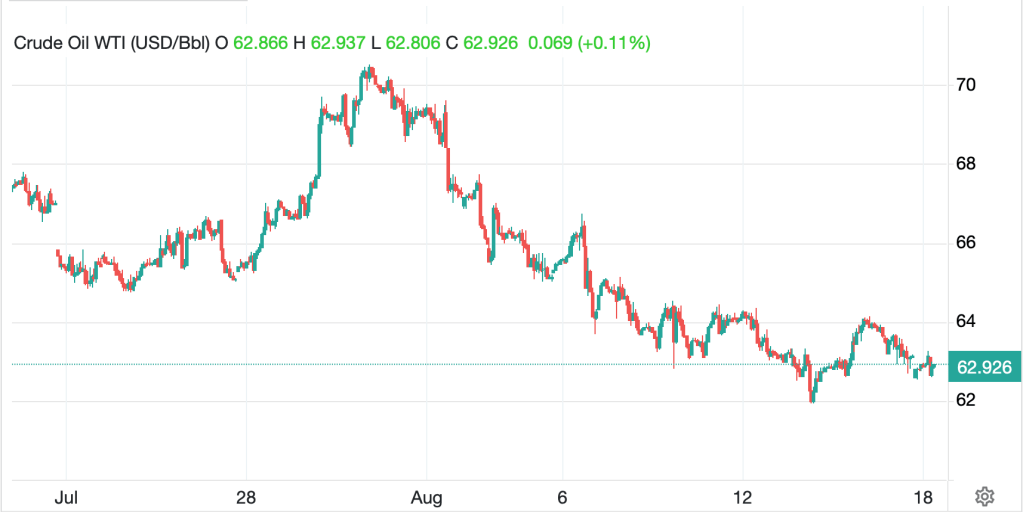

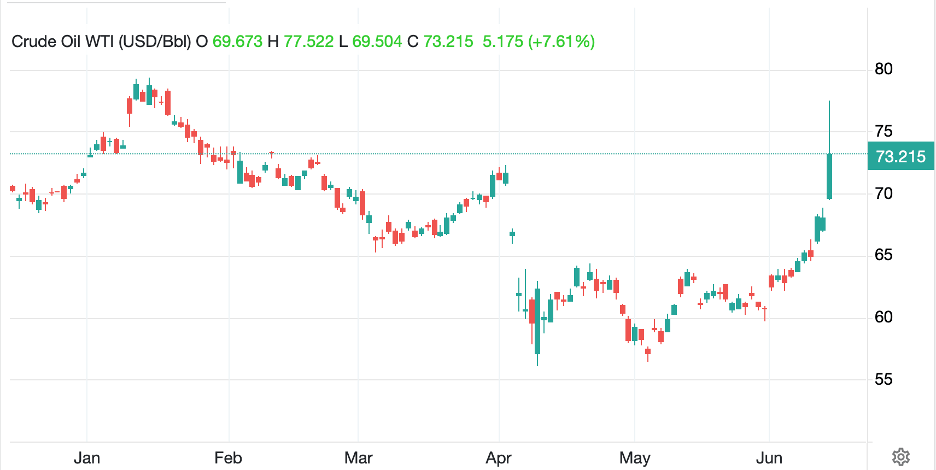

And what of that black, sticky stuff that they drill

Which powers the global economy still

When its price increases, it causes much pain

For most everyone, it can be quite the bane

Consumers, instead, like those prices to sink

But drillers, in that case, cause output to shrink

So, which will it be, will Trump’s mantra come true

Or will, new production, most drillers eschew

I think what is missed is technology’s traction

And how costs per barrel will tend toward contraction

As well, nations worldwide, at last understand

That Carbon Dioxide just cannot be banned

Come Christmas, next, we will see growth in supply

With Fifty per barrel the price we’ll espy

The last place to look is at bright things that shine

Which saw prices move in a vertical line

While gold was the starter, by year end t’was clear

That silver and platinum said, wait, hold my beer

The latter two rising thrice fifty percent

With neither responding to any event

Which brings us to this year, can these trends maintain?

Or are we now set up for infinite pain?

It seems to me that til the summer at least

All three will continue to rise, as with yeast

But when we reach solstice do not be surprised

If views on their future become bastardized

In other words, look for corrections in price

With early year gains given back in a trice

But still, by the end of the year I believe

Five Thousand in Gold is what we will perceive

For Silver, One Hundred could well be the spot

And Platinum, Three Grand, would not be too hot.

To all of my readers and friends, please forgive

My musings if they got too ruminative

This year will see change across many degrees

And some will be painful, while others will please

In sum, I think President Trump can succeed

In changing behavior, though not corporate greed

Reducing the number of government staff

As well as with regs, he can cut those in half

Inward investment will focus on stuff

Instead of on stocks, for the markets that’s rough

Dollars will still be in greater demand

While Treasury yields will be stuck in the sand

IG and Junk are unlikely to win

As rising expenses cut margins quite thin

And still, through it all, precious metals will gain

Though G7 central banks all will abstain

Come Christmas next, nothing will look quite the same

And maybe my views can help you build a frame.

Thank you all for tolerating my punditry and I hope that you all have a wonderful, healthy and successful year ahead.

Adf